A global view: Interest rates and core fixed income

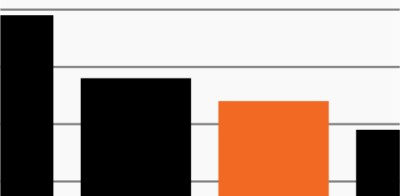

Source: Bloomberg Finance, L.P. and FS Investments, as of June 8, 2022. Chart shows the 10-year yield on each country’s government bond. Agg and Global Agg refer to the Bloomberg U.S. Aggregate Index and Bloomberg Global Aggregate Index.

- The Federal Reserve recently ramped up its efforts at battling inflation, initiating quantitative tightening, whereby it began actively reducing assets on its balance sheet. Meanwhile this week, Treasury Secretary Yellen warned that the U.S. could face a prolonged period of elevated inflation.

- The battle will soon turn global as European policymakers laid out plans to hike rates in July, which would be the first increase in more than a decade. The European Central Bank (ECB) also expects to end its large-scale bond buying program at the same time.

- Amid the protracted inflationary environment, U.S. Treasury yield’s climb this year has been no secret. As the chart shows, however, the spike in government bond yield has been felt fairly uniformly across much of the developed world.

- Rising rates’ impact on duration-sensitive assets this year has been acute. Large-cap growth stocks are down -21.5% year to date compared to -4.8% for large-cap value stocks.1 Meanwhile, domestic and global core fixed income, which investors traditionally rely on as a portfolio stabilizer, is down -9.8% and -12.3% as rising income hasn’t been able to offset deep price declines.1

- Against a backdrop of sustained global inflation, rising government bond yields and falling fixed income prices, investors may be wise to seek alternative sources of income that have the potential to generate real income across varying rate and macro environments.