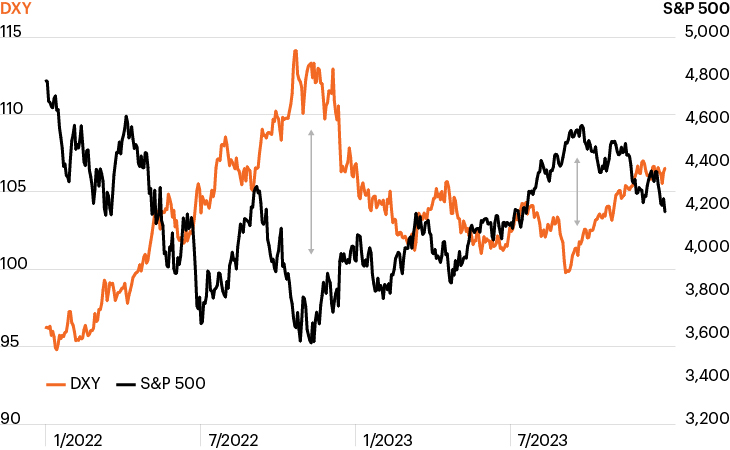

The dollar and U.S stocks: An inverse relationship

Source: Bloomberg Finance, L.P., as of October 25, 2023. DXY Index refers to the U.S. dollar spot rate.

- U.S. equities have had to contend with a range of headwinds in recent months, highlighted by heightened geopolitical uncertainty and sharply higher interest rates as investors have accepted the Fed’s higher-for-longer narrative.

- The resurgent U.S. dollar is now on the list of potential challenges, with its surge higher since July, driven by an aggressive Federal Reserve and the extraordinary resilience of U.S. economic data.

- Historically, U.S. and global equity markets have an inverse correlation to the dollar, with periods of dollar strength coinciding with weaker equity markets.

- As the chart shows, the S&P 500 saw a steep decline throughout the first nine months of 2022 as the dollar hit multi-decade highs. The late September 2022 trough in equity markets coincided with the dollar’s peak. The inverse is true today as the S&P’s struggles have aligned with the dollar’s renewed appreciation.

- Clearly, there are multiple issues at play with the S&P’s recent inflection points. Yet the dollar’s appreciation poses an additional headwind to an already-challenged equity landscape and reinforces the importance that investors seek alternative sources of growth.