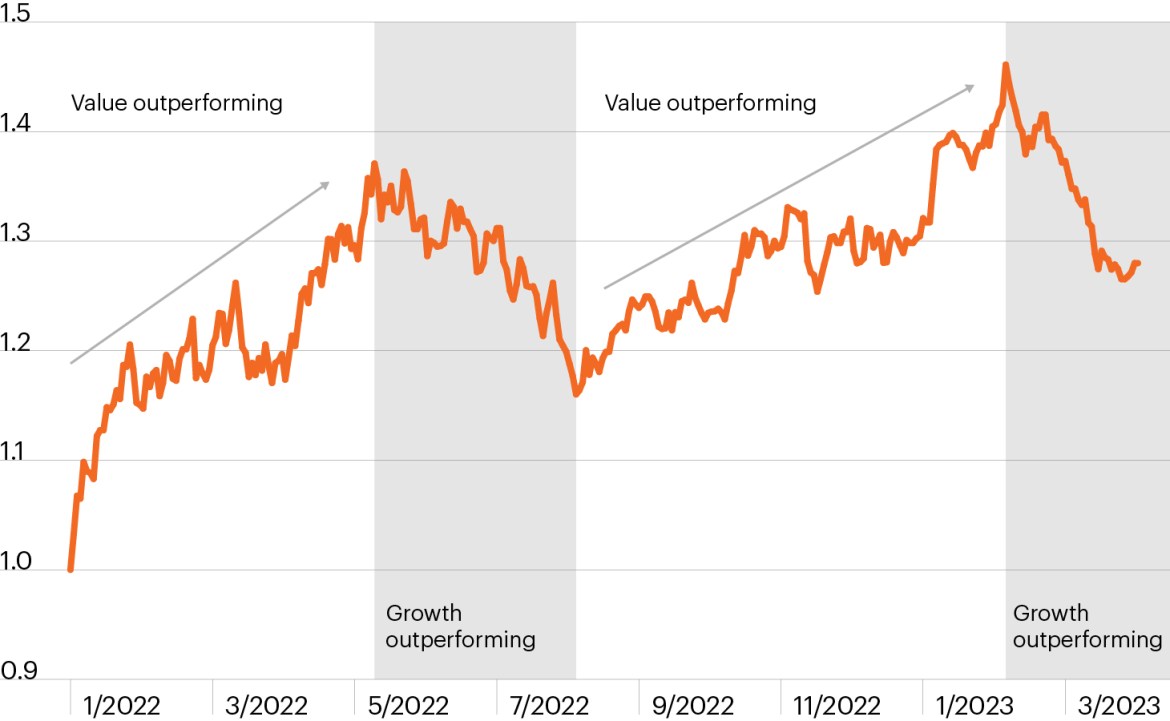

Ratio of value to growth stock performance

Source: Bloomberg Finance, L.P, as of March 30, 2023. Based on the S&P 500 Pure Value Index and S&P 500 Pure Growth Index.

- U.S. stocks have risen more than 5% in the first quarter of 2023, as investors have shaken off a range of macro headwinds, and focused instead on a gradual easing in inflation, resilient economic growth and, recently, a repricing of Fed rate expectations materially lower.1

- As the chart shows, U.S. growth stocks have led market performance this year after being decimated in 2022. The trend accelerated in recent weeks alongside plummeting Treasury yields amid the collapse of Silicon Valley Bank (SVB) and Signature Bank.

- The swift change in market leadership between value and growth stocks has occurred alongside similar reversals between international and U.S. stocks. International stocks began to reassert themselves in Q4 2022, and have slightly outperformed YTD, despite some reversion toward growth-oriented U.S. stocks.

- Rapid changes in investor sentiment and, in turn, market leadership highlights the importance of flexibility and active management in the current market environment.