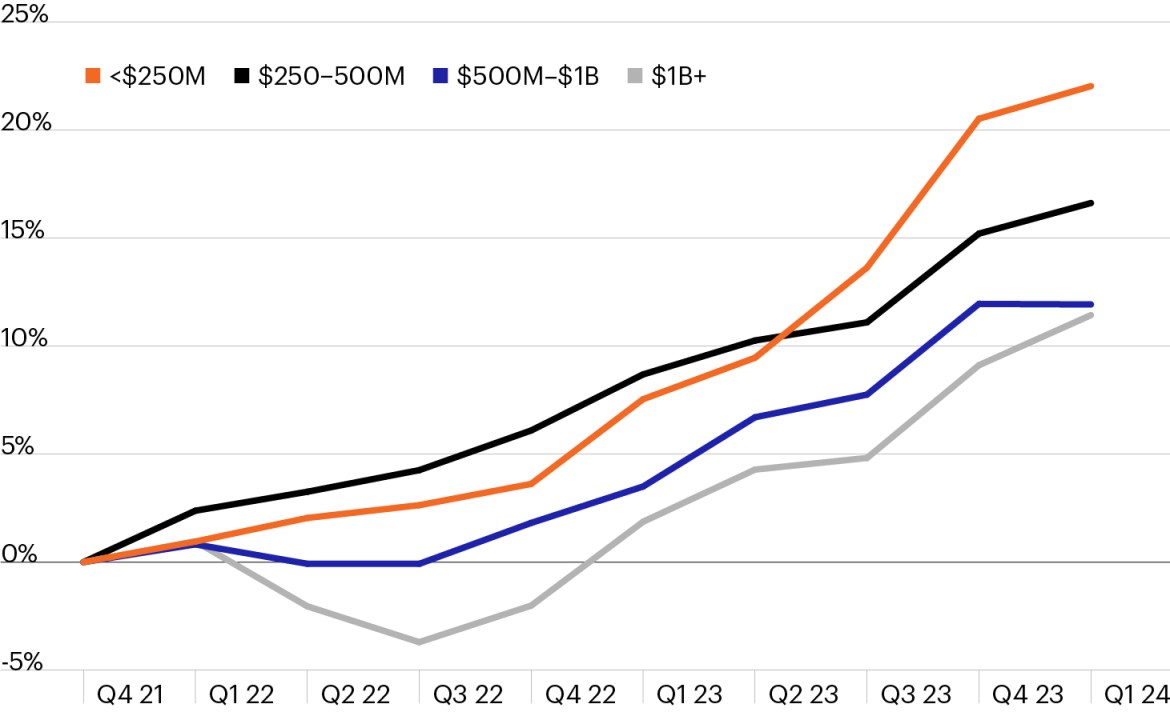

Private equity returns by fund size since Fed rate hike campaign began

Source: Pitchbook, as of March 31, 2024, latest data available

- The elevated rate regime of recent years has had a relatively muted impact on the U.S. economy as economic growth has continually outperformed consensus forecasts. Its impact on private equity (PE) markets has been clearer and more direct.

- Deal activity was quiet during the past two years before the Fed’s September rate cut slowly helped bring buyers and sellers back to the table. PE returns have diverged, however, as lower and middle market funds significantly outperformed mega cap since the Fed’s rate hike cycle began.1

- Large and mega cap PE managers traditionally rely more on leverage to drive returns and were especially hampered by the Fed rate hiking cycle as higher rates drove up financing costs. Meanwhile, middle market PE managers tend to derive a higher percentage of value creation through organic growth (such as improving earnings, growing margins and expanding product lines) and are less reliant on leverage and multiple expansion.

- More Fed rate cuts could serve as a tailwind to PE performance across all sizes. But the combination of a solid U.S. economy and sticky inflation have caused markets to meaningfully trim their rate cut expectations, calling into question how much more return PE managers can source through lower financing costs and multiple expansion.

- Against this backdrop, we believe the diverse makeup of the middle market and its greater reliance on fundamental performance to drive returns versus large cap funds makes it an attractive source of diversification and growth potential.