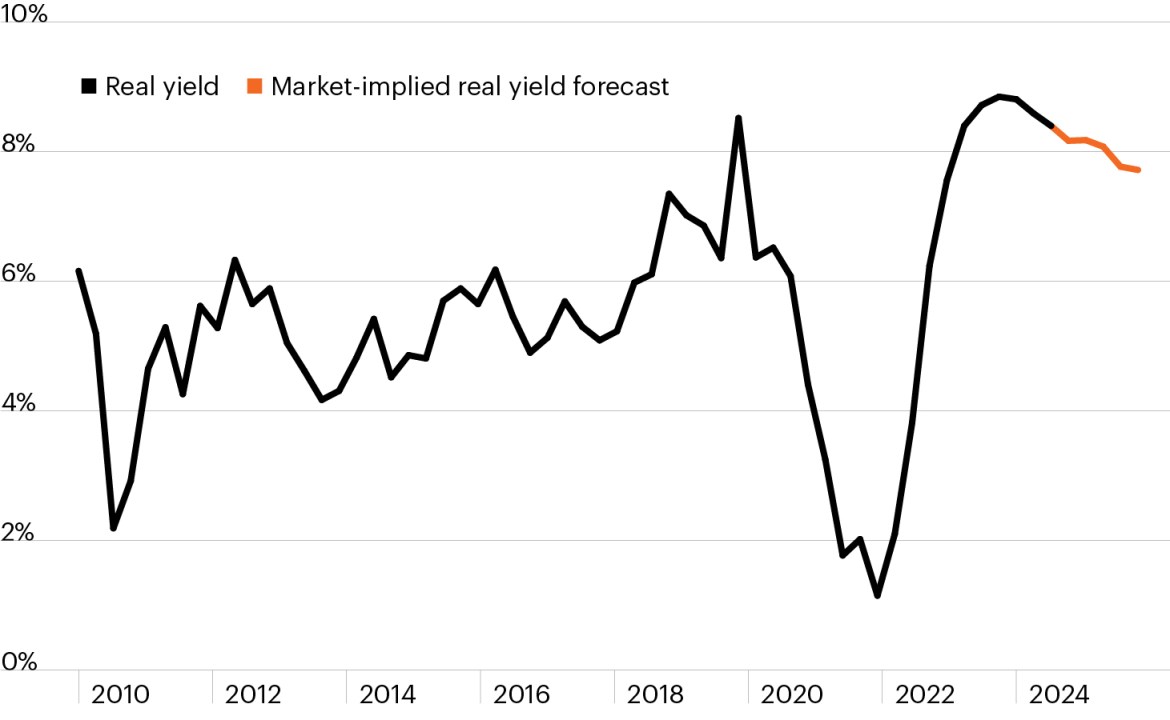

Private credit real yields, forecasted real yields

Source: Cliffwater, Bloomberg Finance, L.P., as of September 30, 2024. Market-implied forecast based on Fed funds futures prices and Bloomberg consensus CPI estimates as of November 7, 2024.

- Yields across credit markets have declined this year as the economy remains resilient and the Fed cuts rates. Yields on private credit have been no exception.

- But even with the 75bps in cuts Fed policymakers enacted during their last two meetings, private credit retains attractive nominal and real (inflation-adjusted) yields of approximately 11% and 8.4%, respectively.1

- If the Fed reduces rates by another 75bps by December 2025 (as the market expects), a private credit nominal yield of around 10% would likely imply a real yield of approximately 7.7%—higher than in 80% of cases throughout the market’s history.1

- Furthermore, lower rates in the absence of a recession would likely spur a rebound in merger and acquisition activity, which we have already begun to see.

- Altogether, real yields on private credit should remain attractive relative to history even if the Fed continues to methodically reduce its policy rate, particularly if inflation continues to normalize.