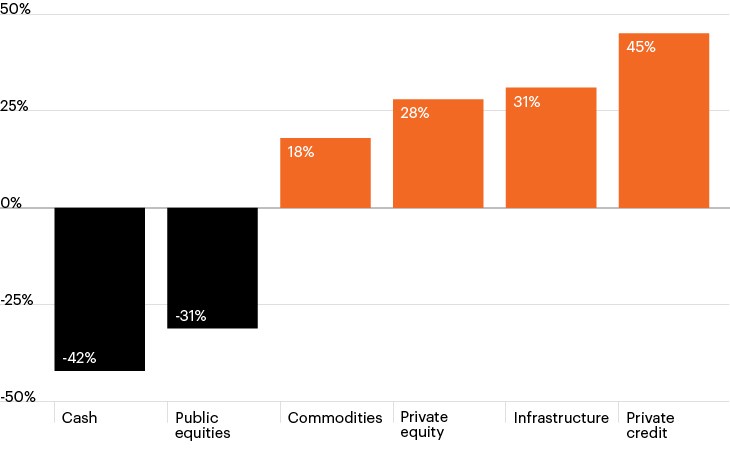

Expected family office allocation changes in 2024

Source: KKR 2023 Family Capital Survey, as of January 31, 2024.

- Stocks’ strong return last year combined with the S&P’s historically high valuations today has left many investors with a difficult allocation challenge. The S&P’s historic levels of concentration in mega cap tech stocks may make allocation decisions more difficult.

- What’s more, some investors may have missed out on last year’s rally if they were overallocated to cash. More than $1 trillion flowed into risk-free money market funds in 2023 amid near omnipresent recession speculation and the elevated rate environment.1

- Against this backdrop, a survey of family offices released this week showed how some Chief Investment Officers plan to tackle these allocation challenges—moving toward private and alternative investments.

- As the chart shows, family office respondents overwhelmingly expect to reduce their allocations to cash and traditional public equities in favor of private equity and private credit, among other asset classes.2

- Both asset classes may be particularly attractive today. Private credit offers investors a potential yield premium over syndicated loans within today’s competitive credit market. On the other hand, private equity offers investors compelling growth potential with limited correlation to traditional public equity markets.