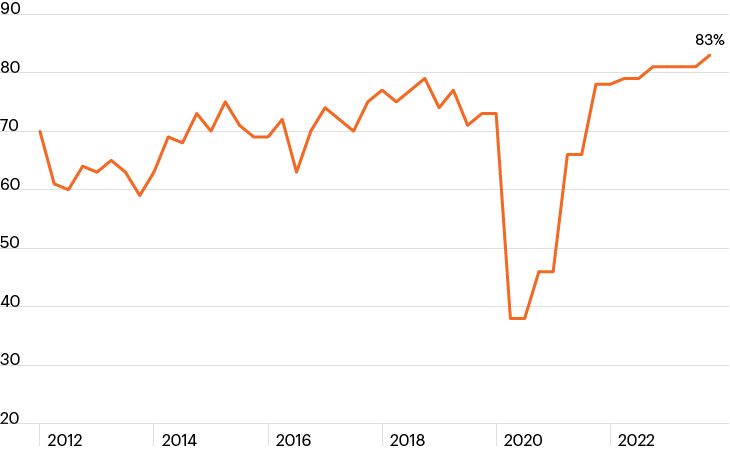

Percent of middle market companies reporting positive annual revenue growth

Source: Macrobond, as of October 31, 2023. Latest data available

- Historically high valuations for public U.S. large-cap equities (particularly within the Magnificent Seven, which represents a growing portion of the S&P 500), coupled with the paucity of compelling economic environments outside the U.S. leaves investors with an uncomfortable allocation challenge in 2024.

- To address this challenge, investors may turn to the robust opportunity set in the U.S. middle market, including private middle market investments.

- Comprised of more than 200,000 firms with revenues of $10 million to $1 billion, revenue growth among middle market companies has historically outpaced the S&P 500. In recent years, it has been much more stable than its large-cap peers as nearly all revenue (84%!) comes from within the U.S.1

- Eighty-three percent of middle market firms reported positive year over year (y/y) revenue growth, representing the highest number on record.2 Despite the challenges from higher interest rates and slowdowns in select industries, fundamentals within the broader domestic middle market remain rock solid.

- Against this backdrop, investors may be wise to allocate toward private middle market debt or equity investments if they seek to generate above-market income or growth potential.