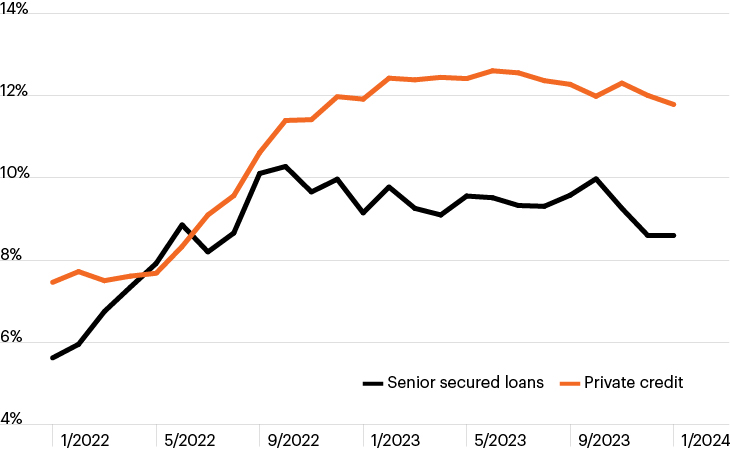

Yields on private and public debt investments

Source: J.P. Morgan as of January 2024. Private credit yields based on a composite of J.P. Morgan private credit transactions’ yield to maturity at transaction close. Senior secured loans based on J.P. Morgan Loan Index.

- Once a niche asset class, the private debt market has grown to $1.6 trillion in assets and is a critical source of financing for corporate borrowers. As banks pulled back from non-core lending activities and narrowed their focus to core sectors and clients, private, non-bank lenders have stepped in to fill the void.1

- Private lenders’ growth has helped broaden the capital sources available to small- and medium-sized borrowers. In addition, private lenders typically provide more customized financing solutions for corporate borrowers compared to the syndicated loan market.

- For investors, adding private debt to a portfolio of traditional stocks and bonds may help deliver a high level of income and diversification potential.

- Even amid the elevated rate environment of the past year, an index of private credit investments maintained a yield premium of about 300 basis points over that of the broadly syndicated leveraged loan market, as the chart highlights.2

- At a time when equity valuations are elevated, the rate outlook remains volatile and the correlation between stocks and bonds is high, private debt may provide an attractive opportunity for investors seeking above-market yields and the potential for portfolio diversification.