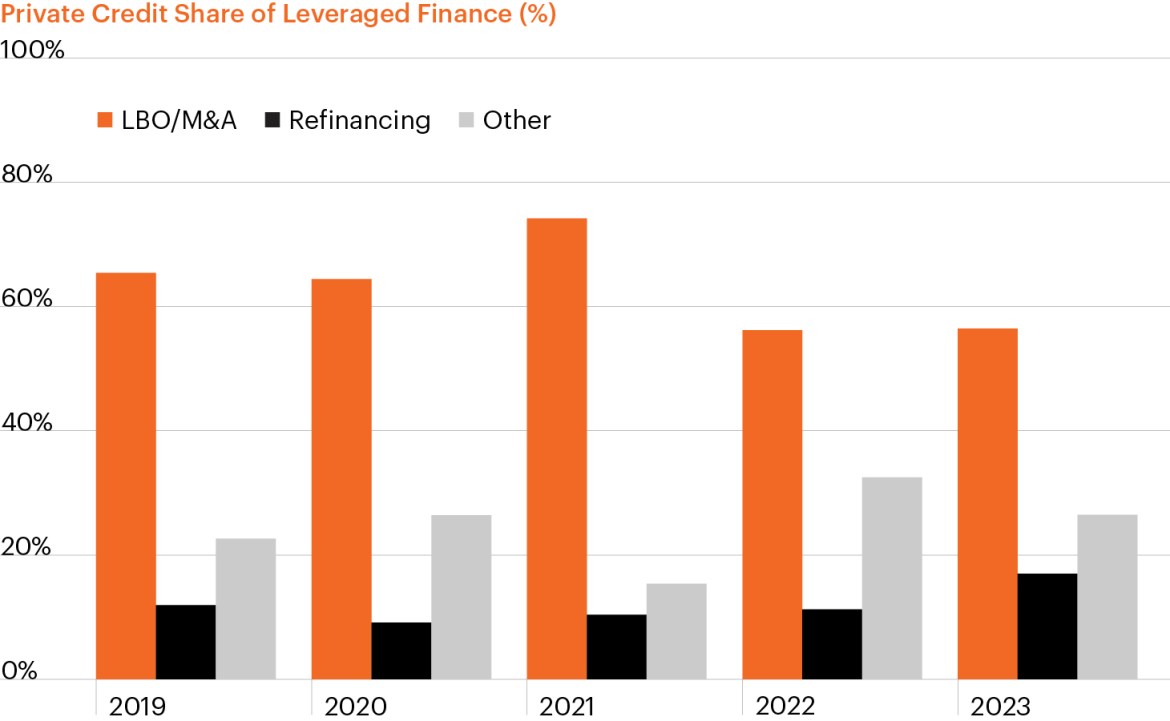

Private credit major source of LBO/M&A financing

Source: J.P. Morgan, Pitchbook.

- Private credit has seen massive growth over the last decade, representing well over $2.0 trillion in assets under management according to some estimates as it has transitioned from a niche asset class to an increasingly important source of capital for small and medium-sized borrowers.1

- Growth in the asset class has been driven by private, non-bank lenders increasingly stepping in to fill the void left by banks as they pulled back from non-core lending activities and narrowed their focus to their core sectors and clients.

- As the chart shows, private credit has become private equity sponsors’ major source of funding for leverage buyout (LBO) and merger and acquisition (M&A) activity, accounting for well over half of all LBO/M&A activity during the past five years.2

- Private equity sponsors and portfolio companies have found private credit an increasingly attractive option to provide efficient, customized financing solutions compared to the syndicated loan markets while working with a single lender.

- For their part, investors also have found private credit an attractive allocation, potentially helping deliver above-market yield and the potential for portfolio diversification.