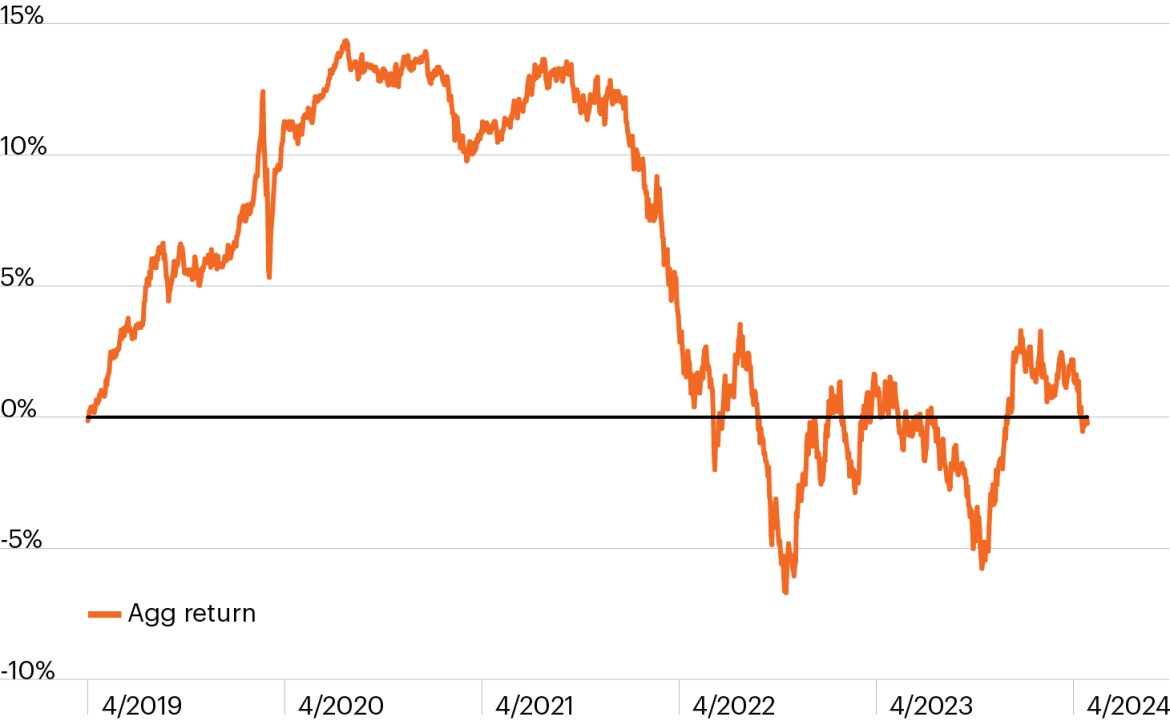

Bloomberg U.S. Aggregate Index total return

Source: Bloomberg Finance, L.P., as of April 24, 2024.

- The traditional 60/40 portfolio has generated a solid 14.3% return over the past year.1 Looking underneath the hood, however, reveals “the 40” is not pulling its weight.

- The Bloomberg U.S. Aggregate Index, the 40 within the 60/40 portfolio, has been stuck in neutral over the last year, returning -0.9%.1 In fact, over the last five years, the Agg has been exactly flat (-0.09%).1

- As the chart highlights, the Agg benefited greatly from the zero-interest rate policy that prevailed throughout 2020 and 2021 but quickly gave back those returns and then some as the Fed began its aggressive rate hike cycle in 2022.

- Thursday’s release of Q1 GDP and inflation data gave markets a fresh reminder of the challenges the Federal Reserve faces in its quest to bring inflation further closer to its 2% target. Shortly following the report, the 2-year and 10-year Treasury yields climbed to their highest levels since November 2023.1

- The prospect of falling growth and persistent inflation may continue to challenge the performance of a 60/40 portfolio and, in turn, drive investor demand for alternative sources of income, growth and diversification.