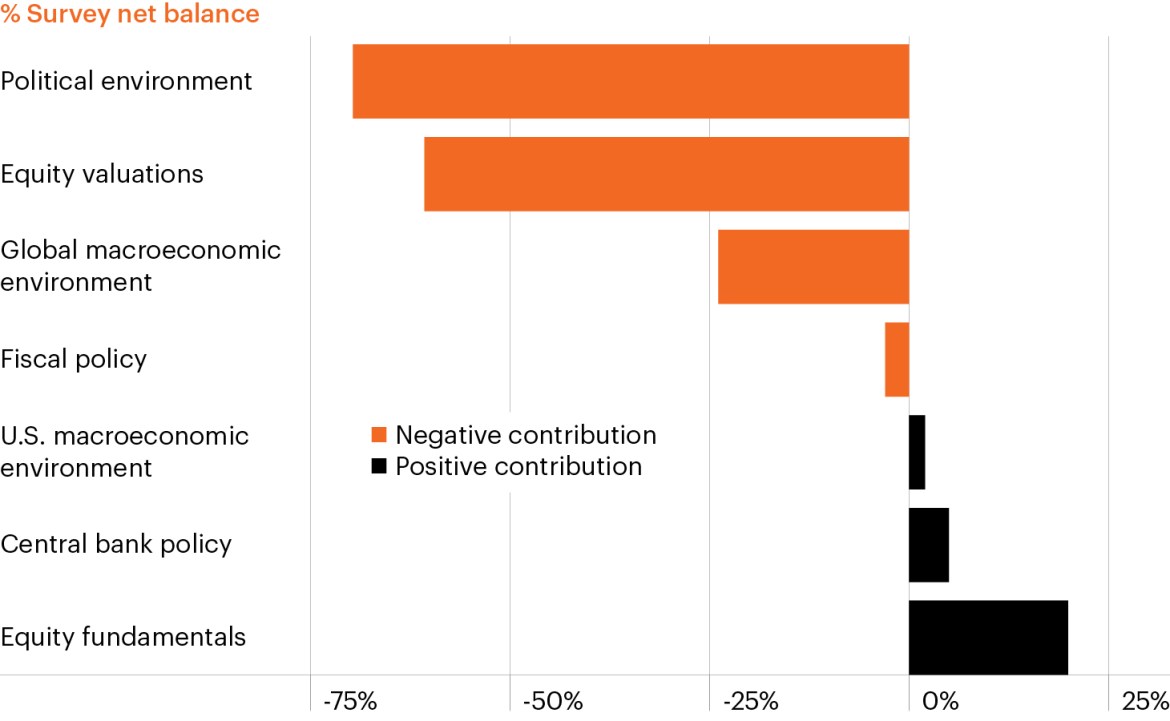

Investor survey: Major equity drivers for the next 30 days

Source: S&P Global Investment Manager Index, based on survey data collected from August 6-9, 2024. The net balance shows the percentage of those reporting an expected positive contribution minus those expecting a negative contribution. Those only reporting a ‘slight’ positive or negative contribution count as half a response, while those reporting a ‘strong’ positive or negative contribution count as one-and-a-half responses.

- Markets have been extraordinarily volatile over the past month, driven by slowing employment data, continued geopolitical tensions and rapidly changing election dynamics. Many investment managers expect the volatility to stay heightened for some time.

- According to a recent S&P Global Investment Manager Index survey, perceived risks have begun to outweigh potential return drivers, reversing an extended period of relative market calm.

- The political environment has quickly raced to the top of investors’ concerns and could remain there through the election. Meanwhile, anxiety surrounding rich equity valuations has been background noise for many investors over most of the past year and remain a concern for many investors.

- Against this backdrop, alternative investments that seek to provide differentiated sources of income, growth and diversification may be particularly important should markets remain as choppy as investors anticipate.