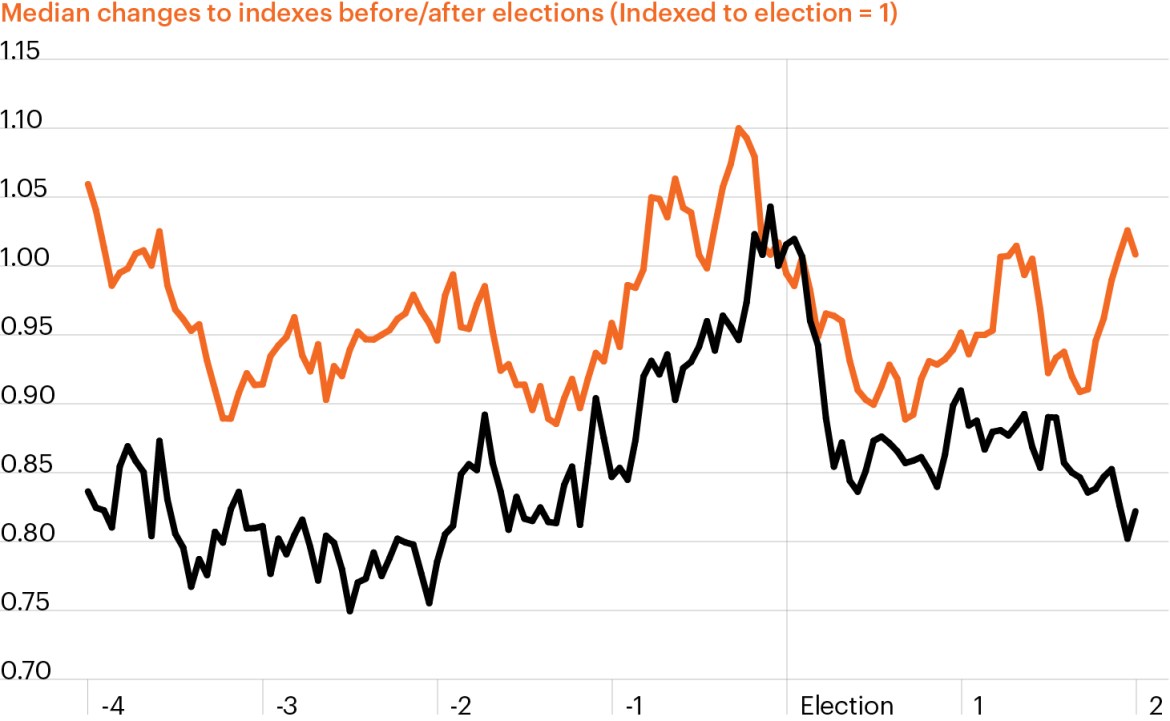

VIX and MOVE spike around elections

Source: Bloomberg Finance, L.P., FS Investments, as of June 30, 2024. Chart measures median changes in expected equity and rate volatility in the months leading up to and after U.S. presidential elections from 1992-2020. MOVE Index refers to the ICE BofAML U.S. Bond Market Option Volatility Estimate (MOVE) Index. VIX refers to the Chicago Board Options Exchange (CBOE) Volatility Index (VIX).

- A prolonged period of relative stability in equity and fixed income markets ended abruptly last week, driven by a mix of lackluster economic data that called the economic soft-landing narrative into question, shifted Fed rate expectations and catalyzed global market volatility.

- Markets settled somewhat this week, yet this recent bout of volatility may be the beginning of a new regime.

- While markets are hyper-focused on whether the Fed can nail the (soft) landing, the U.S. presidential election is poised to keep volatility elevated through the remainder of 2024, as the focus shifts from rate cuts to the election.

- In a close race, market and economic outcomes are hard to predict, but one pattern seems clear: U.S. elections have historically triggered volatility. The chart highlights expected equity (VIX) and rate (MOVE) volatility.1 While rate volatility has been more pronounced around elections, both measures trended up during the two months leading up to an election.1

- Against this backdrop, alternatives may provide investors with differentiated sources of income, growth—and diversification—at a time when markets may continue to face bouts of volatility.