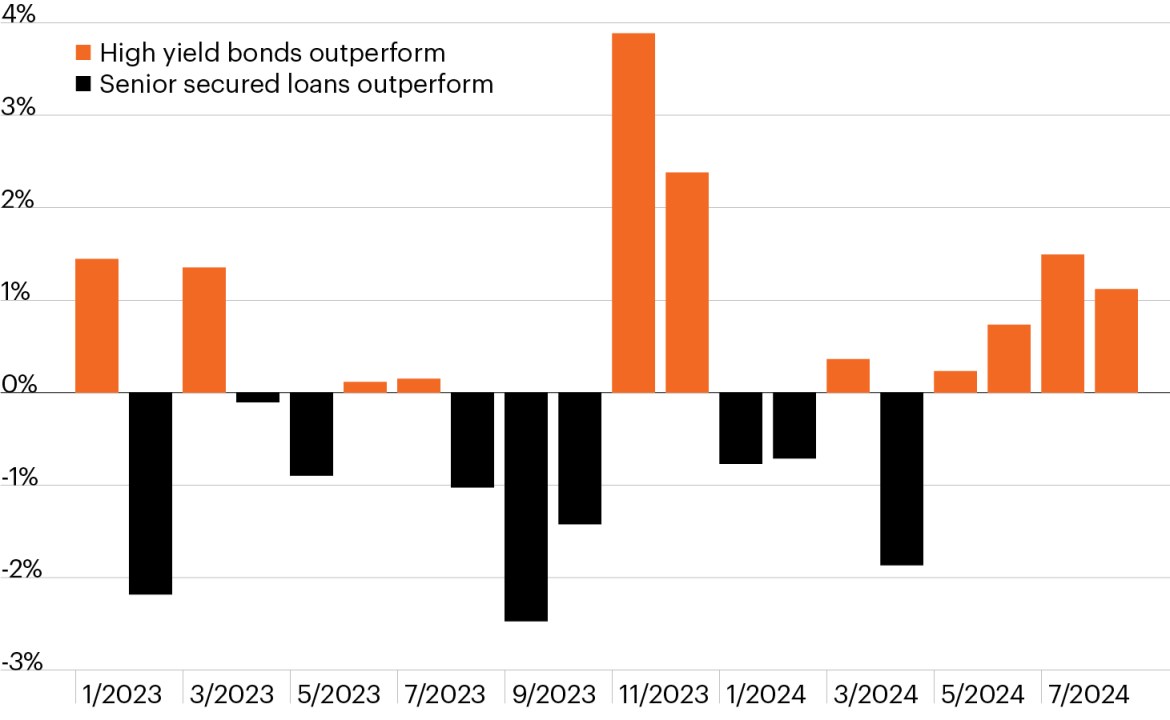

Monthly returns: High yield bonds less senior secured loans

Source: Bloomberg Finance, L.P. as of September 30, 2024. High yield bonds represented by the ICE BofAML U.S. High Yield Index. Senior secured loans represented by the Morningstar LSTA U.S. Leveraged Loan Index.

- Markets have seen significant and rapid changes since Fed policymakers struck a more dovish tone following June’s downside inflation surprise.

- The Magnificent 7 stocks that almost entirely drove stock returns over the past year have faded, while small- and mid-cap stocks have shown signs of life at long last.

- Within credit markets, high yield bond returns began to consistently outpace senior secured loans as the start of a new Fed rate-cutting cycle became clearer. Since May, high yield bonds have returned 6.1% compared to 2.8% for senior secured loans.1

- Credit markets broadly have benefited from their attractive yields during 2024, but fixed-rate high yield bonds have outperformed floating rate loans, driven by their more attractive duration profile amid pending Fed rate cuts coupled with their notably higher credit quality amid signs of an economic slowdown.

- High yield bonds are in favor today over senior secured loans, but the chart also shows the potential benefits of diversification and flexibility when investing in credit markets, as attractive opportunities clearly shift between fixed- and floating rate instruments over the course of multiple market cycles.