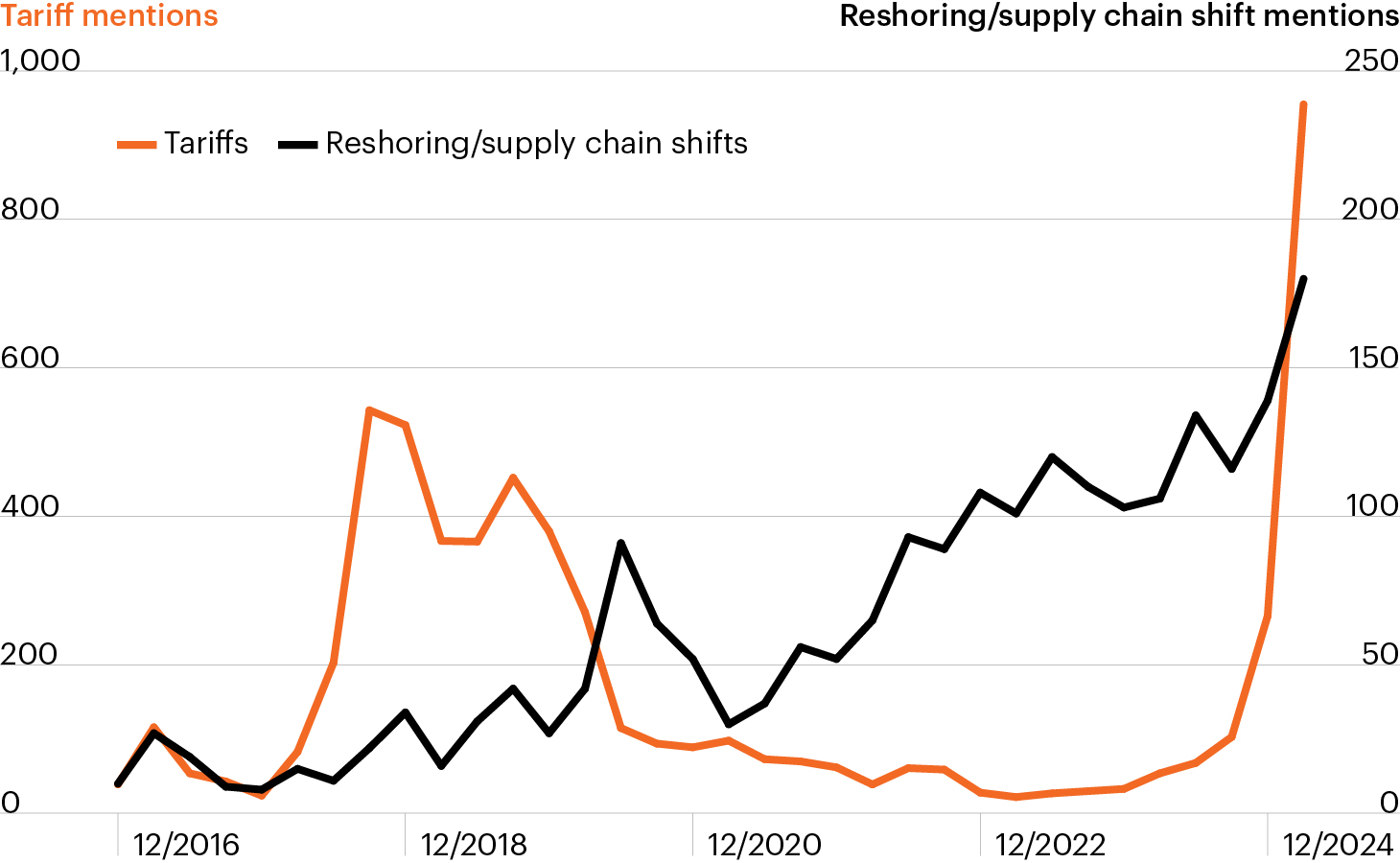

Company mentions of “tariffs” and reshoring/supply chain shifts

Source: Bloomberg Intelligence, L.P., as of March 26, 2025.

- Despite resilient economic data, continued uncertainty surrounding tariffs, monetary policy and economic growth again drove market volatility this week.

- Mentions of tariffs during corporate earnings calls spiked during the first Trump administration, eased under Biden and have gone parabolic in 2025.1 Tariffs appear likely to be implemented much more broadly than in the late 2010s, leading to widespread impacts across industries.

- Public markets sit at the epicenter of the potential financial fallout. Large multinational firms not only operate complex international supply chains, but also their global consumer bases (34% of S&P 500 revenues are sourced from abroad) are highly exposed to retaliatory trade measures.2

- The U.S. middle market may represent a potential shelter from the macro volatility. The private companies that comprise the U.S. middle market tend to have simpler, more domestically focused supply chains than their S&P 500 counterparts, with an average of 84% of revenues generated in the U.S.2

- The middle market also stands to benefit as companies increasingly consider reshoring critical functions to avoid tariffs and/or look for domestic input sources.