Looking at the state of the commercial real estate market and the potential longer-term impacts of the COVID pandemic, I’m reminded of the classic fairy tale Little Red Riding Hood. We’ve clearly left the safety of the village and are traveling through the woods. The question remains, what’s waiting for us ahead – a wolf or grandma?

Before we dive into the analysis, it’s important to remember that commercial real estate is not a homogenous asset class. Each sector, market and individual asset has its own unique dynamic. While the hardest-hit sectors – namely hospitality and retail – have garnered the most attention since the onset of the global health crisis, the market had clearly already begun differentiating between real estate equity sectors.

Oh my, what big dispersion you have…

Prior to the pandemic, we were already starting to see signs of investors becoming more selective among real estate sectors. After the Fed hiked rates in late 2015, price growth dispersion increased significantly as investors became more concerned that low interest rate financing would become less available.

The chart clearly shows that CRE investors began to favor the industrial and multifamily sectors years ago while retail and hospitality fell out of favor. The pandemic has accelerated evolving trends in commercial real estate and consumer behavior.

The shift away from classic retail outposts toward e-commerce has pushed industrial demand higher and dented demand for retail properties. Meanwhile, multifamily has benefited from limited supply combined with strong demand for rental properties from both millennials and baby boomers. Uncertainties around the future of office have created some headwinds to that sector while hospitality, with “overnight” leases and sensitivity to travel restrictions, has been hit hard. (For more information on the dynamics driving these individual sectors, see our quarterly real estate outlooks.)

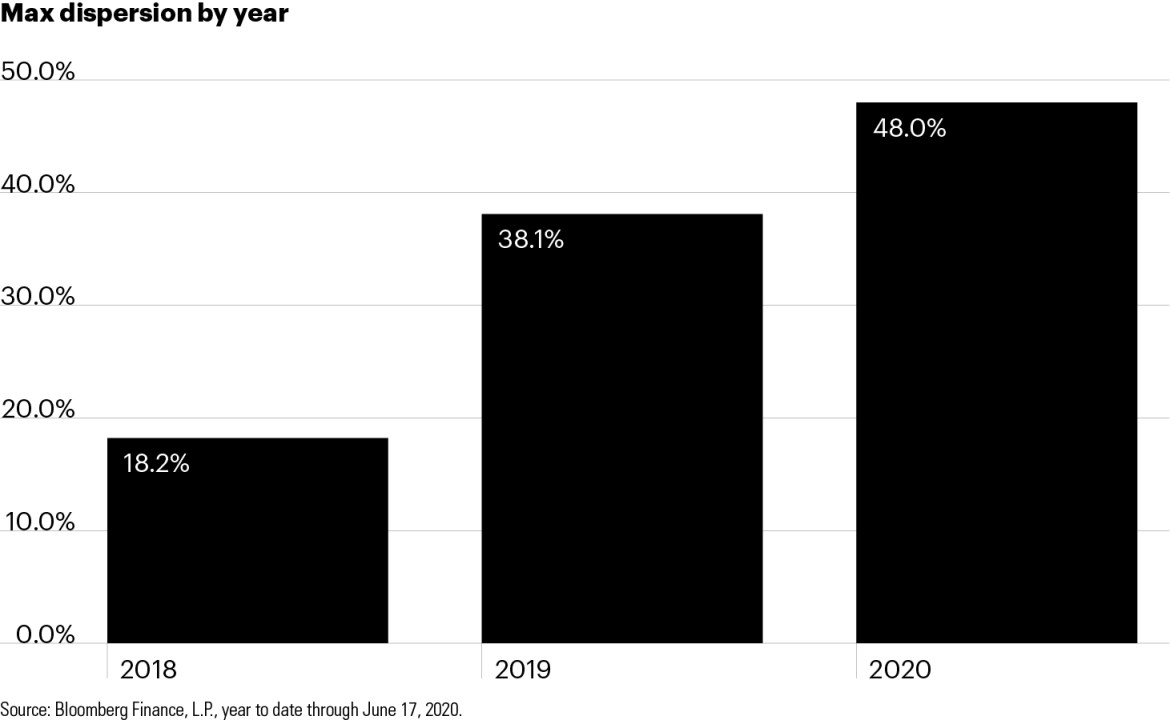

This trend was mirrored in the public markets in the past several years, with sector dispersion becoming more pronounced in the public REIT market. The maximum dispersion of returns between sectors more than doubled between 2018 and 2019, from an already sizable 18% to 38%. In 2020, the sell-off was fairly severe across the board. However, the more favored sectors (industrial, multifamily and, in this case, office) were somewhat more protected. All of this adds up to a nearly 50% dispersion across CRE sectors on a YTD basis.

On the debt side of the ledger, we’ve also seen significant dispersion, except here it has generally followed seniority in the capital structure. With government support being largely limited to AAA rated bonds, the CMBS market has seen stronger recovery in highly rated bonds, although yields have fallen across the board. Yields across the lowest-rated investment grade tranches (BBBs) remain the most elevated as those investors are exposed to the greatest potential losses, while higher-rated tranches have tightened much closer to pre-COVID levels.

Where do we go from here?

So what’s ahead for CRE investors? Based on our analysis, CRE sector selection is important and, for debt investors, so is senior location in the capital stack. So, unlike the girl in the fairy tale, commercial real estate investors have multiple options to navigate through the woods, and outcomes may be based on the path chosen. Considerable macro challenges remain, but investment opportunities in commercial real estate are available for discriminating, active and forward-thinking investors.