Duration, defined

Duration, simply, is a measure of a bond price’s sensitivity to changes in interest rates. Given the inverse relationship between bond yields and prices, a bond with a longer duration should theoretically experience a larger price decline when rates fall than a bond with shorter duration, all else equal. If rates fall, longer-duration bond prices rise more than the prices of bonds with shorter durations. To illustrate, consider a bond with a duration of 6.0. With a 1% rise in interest rates, the bond’s price will fall roughly 6%. With a 1% decline in rates, the bond’s price will rise roughly 6%.

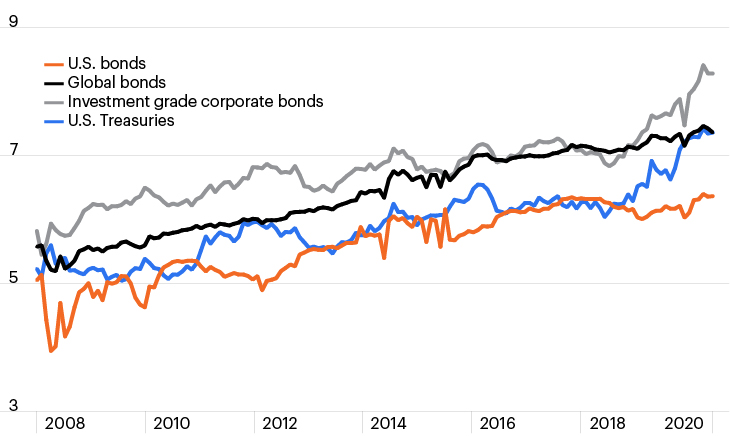

As it relates to the calculation of a bond’s duration, one of the other considerations is that duration rises as yields fall. The consequence of this is that the 40-year global decline in rates has steadily extended core fixed income duration, which is now at record levels for many bond indexes. We saw especially sharp increases in duration this year following the collapse in rates, meaning that even a slight uptick in rates could send bond prices sharply lower.

Duration has extended across the core fixed income universe

Source: Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays Global Aggregate Bond Index, ICE BofAML U.S. Corporate Index, ICE BofAML U.S. Treasury Index, July 31, 2008–September 30, 2020.

Key takeaways

- As yields have fallen, duration has risen for many fixed income indexes.

- Core fixed income indexes are now much more interest-rate sensitive than ever before.

- Empirical duration measures for sub-investment grade credit find that these asset classes are less exposed to duration risk and, in fact, perform well during rising rate environments.