Today’s economic landscape may challenge the performance of traditional investments going forward. Recent positive cyclical momentum looks set to continue for some time, but investors must be cognizant of the late-cycle risks the economy faces. Despite stronger growth, low interest rates could challenge investors throughout 2018 and beyond.

Low yields

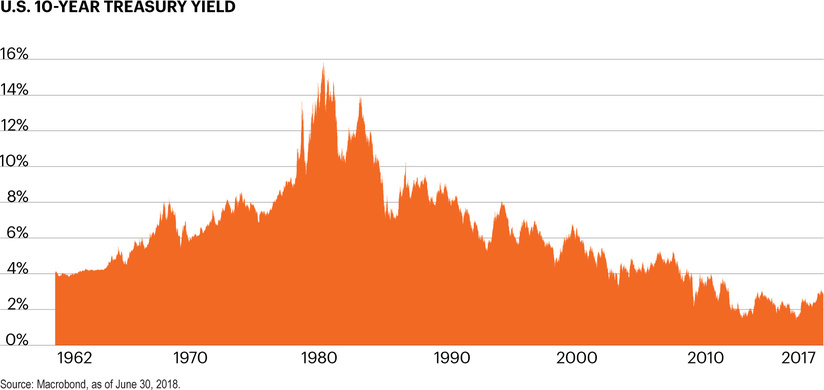

Declining long-run potential growth, contained inflation expectations and low global yields have all put downward pressure on interest rates for years. Interest rates peaked in the high-inflation days of the 1980s, and today’s lower rates mean investors have fewer options to meet their income needs.

Economic indicators

We expect interest rates to remain relatively low for some time, particularly by historical standards. To monitor markets going forward, we are watching:

- Fed rate hike cycle

- Core inflation

Fed rate hike cycle

The Federal Reserve began an extremely measured rate hike cycle over two years ago and, so far, has raised rates only 175 bps. As the economy appears to be gaining solid footing, the Fed expects to quicken the pace of rate hikes, with between 100 and 150 bps of further rate hikes expected by the end of 2019. Yet while the Fed is more intent on “renormalizing” rates, even these expected hikes will leave rates low by virtually every historical comparison. It is important for investors to understand that a more proactive Fed does not solve the income challenge on its own.

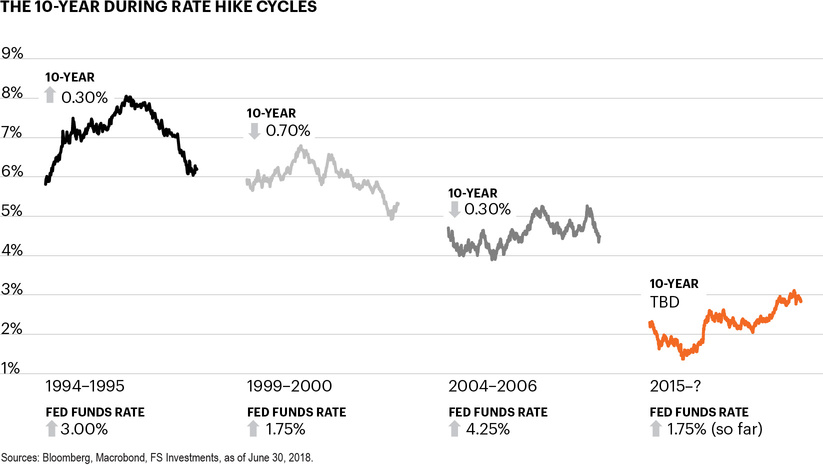

We will be watching: There does not appear to be a correlation between the federal funds rate, which is an overnight rate, and longer-term yields, which are the source of the majority of investors’ income returns. The above chart shows the movement of the 10-year Treasury yield during the past four rate hike cycles. Long-term rates reflect investor expectations of growth and inflation rather than Fed policy. Absent a real uptick in wage growth and inflation, we are skeptical that long-term rates will rise significantly, especially with global yields remaining so low.

Risks to our view: U.S. interest rates could begin moving significantly higher due to an increase in wage growth and inflation. Inflation expectations have stumped the Fed during this expansion, which has caused the market to react considerably when inflation data is released. If year-over-year wage growth starts to approach 3.5%, the prior expansion high, we may finally see an uptick in inflation, which could push long-term yields upwards.

Core inflation

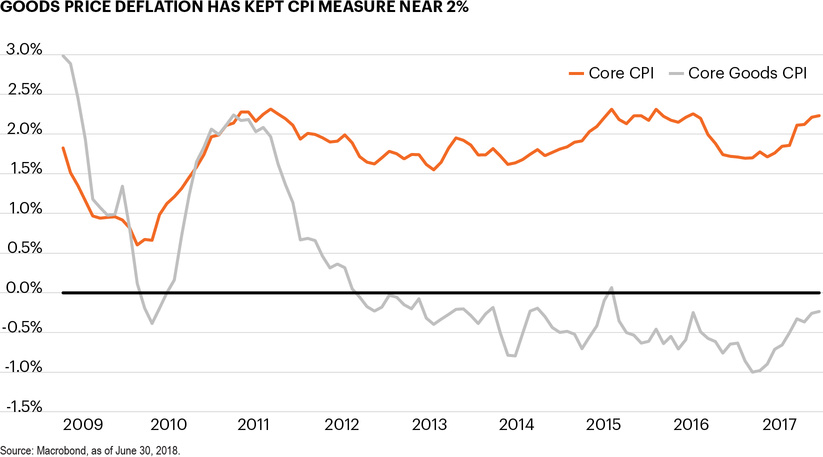

Inflation remains squarely on the radar screen as a driver of interest rates, particularly when the labor market is tight and the unemployment rate is below 4%. Yet core CPI, a measure of consumer price inflation which excludes food and energy, has been remarkably well behaved, staying near the Fed’s 2% target for most of the current economic expansion. Services prices, particularly medical care and shelter costs, have consistently shown faster price growth than the overall index. Offsetting upward price pressure from services has been goods price deflation. Goods make up only 20% of the core index, but goods prices have been in deflation since 2013, meaning goods prices have actually fallen. This has been critical in keeping overall inflation in check for the past several years.

We will be watching: The increased trade-related rhetoric from the Trump administration bears close watching because it could push goods price inflation higher, affecting the broader inflation picture. So far, President Trump’s trade policy has imposed tariffs on $34 billion worth of Chinese goods, but more is expected as the rhetoric of escalation remains pronounced and trade tensions are also heightened with the EU and Canada. Our base case is that the U.S. and its trade partners can negotiate ways to avoid these potential trade wars, allowing for goods inflation to remain muted and core inflation to remain near the Fed’s 2% target.

Risks to our view: Should the administration impose tariffs on a wide range of goods from a large number of trading partners, goods prices could rise, pushing broad-based inflation meaningfully above 2%. The Fed may view this as a tax, however, and in our view would be unlikely to respond to tariff-driven inflation with an aggressive series of rate hikes.

Learn more

Real GDP growth has trended lower over the last 50 years, caused primarily by slowing labor force growth and productivity. Positive cyclical momentum caused growth to pick up in the second half of 2017, and optimism is high that 2018 will see a further boost from pro-growth policies. Yet the gravitational pull of structural headwinds is powerful, and over the long term we believe investors may need to prepare their portfolios for a lower-for-longer growth environment.