With the U.S. election now less than two weeks away, markets are squarely focused on the outcome and implications for the economy, interest rates and equities. Polls currently point to a possible “blue wave,” with Democrats controlling both houses of Congress and the White House. This outcome could mean major policy changes and therefore implies greater uncertainty. While polling suggests this scenario has become increasingly likely, much uncertainty remains around both the outcomes and the market impacts.

Feeling blue?

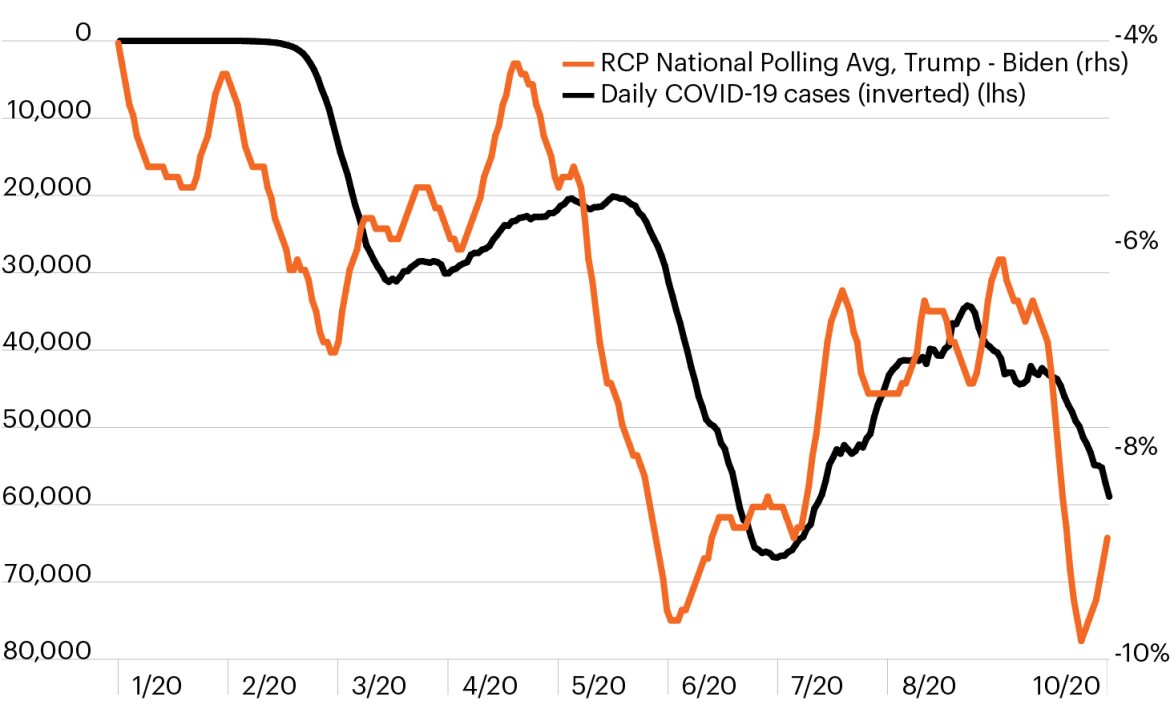

Current polls suggest Democratic challenger Joe Biden has a roughly 9‑percentage point lead nationally over Republican President Donald Trump, with a lead in many major battleground states, according to Real Clear Politics.1 The pandemic has emerged as the single overriding issue of the election, driving much of the polling, even as the economy has staged an extraordinary bounce in the third quarter that has far outpaced what economists had expected.

Presidential election polling has tracked virus path

Source: Real Clear Politics, The COVID Tracking Project, as of October 20, 2020.

Even if Biden were to win the presidency, however, policy implications would likely hinge significantly on whether the Democrats can gain majority control of the Senate as well. Currently, Democrats face a 53‑47 deficit in the Senate and would need to turn at least three seats in order to gain control. (If the chamber is split evenly, the vice president is the tie-breaking vote, meaning the party winning the presidency would have effective control in the Senate.)

Betting markets currently show a 63% chance of the Democrats taking control of the Senate and a 53% chance of a blue wave, which entails Democrats controlling of both houses of Congress and the White House.2 However, outlier outcomes have been the norm for 2020, not the exception. It is worth considering the policy proposals of both candidates as the November 3 election nears.

Key takeaways

- Current polling suggests Joe Biden holds a national lead over President Donald Trump, though uncertainty remains.

- A “blue wave” would likely result in the most significant policy changes.

- The ability of either candidate to implement their policy platform depends significantly on whether their party controls the Senate.

- The election poses significant uncertainty for both equity markets and interest rates.