For much of the past decade, the equity market narrative was dominated by the rise of large U.S. tech firms amid a world of slow growth and low interest rates. As the global economy enters a new expansion, a different market paradigm — the so‑called “reflation” trade — has come to the fore.

Key takeaways

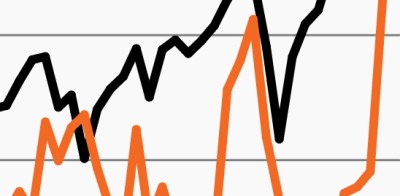

- The rally in global equities, which was initially led by resilient tech firms, has shifted since late 2020 to cyclical areas of the market.

- Reflation dynamics have historically benefited cyclical stocks, which exhibit higher levels of operating leverage.

- Markets have moved quickly to price in a better economic future; however, there is reason to believe the reflation trade has further room to run.

- Outside the U.S., Europe and emerging markets offer interesting ways to get exposure to global reflation.

Following a dislocation remarkable for both its depth and transience, equity markets rapidly recovered from the depths of the COVID-19 crisis. Markets were vindicated in their view that the impact of the pandemic on company earnings would be sharp but fleeting, illustrated by the fact that in the U.S., Q4 S&P 500 EPS have eclipsed 2019 levels.1

“Recovery” may not be the appropriate word for markets anymore — indexes across the globe continue to hit new all-time highs. In the U.S., the S&P 500 and Russell 2000 are each more than 10% above pre-crisis highs, while emerging markets and Japanese equities have each broken above multidecade trading ranges.1 It would appear, for now at least, that global markets are pricing in robust economic growth for the foreseeable future.

No doubt, the future has begun to look brighter for economies across the globe. The IMF recently upgraded its 2021 global GDP growth estimate to 5.5%, which would be the strongest since 2007. The combination of unprecedented government aid, a vaccine-led reopening and pent-up demand is expected to lead to strong global growth and, potentially, higher inflation.2

Certainly, these dynamics have had a massive impact on equity market leadership. High-growth, stay-at-home stocks led the market out of the spring doldrums, but since the events of early November (i.e., the U.S. election and news of viable COVID vaccines), it has been cyclical, small-cap and value stocks that have led.

In many ways, this “reflation” trade is typical of an early-cycle environment. What is unique about the current situation is how quickly markets have moved to price in a brighter outlook. In this note, we put reflation in a historical context and identify the equity market sectors that have typically benefited. Then, we analyze the current environment and explain why, despite the seemingly unrelenting rally, we still see opportunity in today’s market.