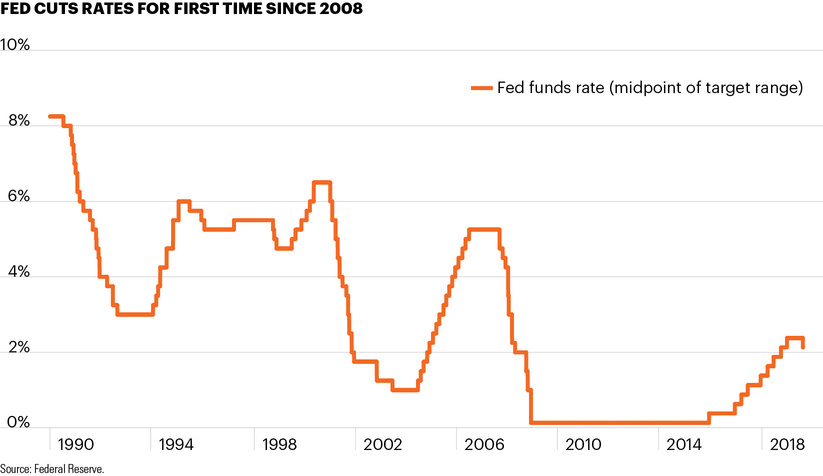

The FOMC cut rates 25 bps to 2.00%–2.25% on Wednesday, as widely expected. The statement aimed for a neutral tone with a return to data-dependent discipline. Fed Chair Powell’s follow-up press conference, however, directly forced markets to confront rate cut expectations that had become too dovish. In the end, the market’s reaction ranged from disappointed to confused. We expect shifting Fed rate expectations to continue to drive market volatility in the second half of the year.

The Fed’s statement

The assessment of the U.S. economy was unchanged. Economic growth is still “moderate,” the labor market is still “strong,” and inflation is still “muted.”1 The statement tried to encapsulate all of the reasons various Fed officials have given for a rate cut, including slowing global growth, persistently low inflation, the need for an “insurance” cut and rising uncertainty related to trade. Two regional Fed presidents (Kansas City Fed President George and Boston Fed President Rosengren) dissented in favor of no rate change.

Powell’s press conference

Fed Chair Powell struck a decidedly more hawkish tone to directly address market expectations of almost 3 rate cuts in 2019 and about a 100 bps of cuts over the next 18 months.2 He chalked today’s rate cut up to a “mid-cycle adjustment to policy” and “not the beginning of a long series of rate cuts.” Here is where I point out that transparency doesn’t equal clarity. If the Fed has taught us anything this year, it is that it is possible to overcommunicate: He quickly added, “I didn’t say just one rate cut.”

Confused?

So were markets. The 10-year was 2.03% just before the meeting, fell below 2.01%, then surged to 2.07% before ending the day at 2.0050%. Equity markets, which were broadly flat before the 2 PM announcement, sold off on the comments. The S&P 500 ended down 1.09%.

End of portfolio runoff

The Fed ended its balance sheet reduction, also as expected. The reasoning is that the Fed does not want balance sheet policy to act in conflict with interest rate policy. In other words, lower interest rates (adding liquidity) while reducing the balance sheet (reducing liquidity) doesn’t make sense. For now, the plan is to hold the size of the balance sheet steady at $3.8 trillion with full reinvestments of maturing assets.

Market rate cut expectations have cooled

Markets still place 62% odds of a rate cut at the September 17–18 meeting, which in some ways makes sense.3 The reality is that to actually impact the U.S. economy, a single rate cut is not enough. We may yet find ourselves on autopilot toward another rate move, despite what looks to be an economy already growing above its potential. Markets are now closer to expecting just one more rate cut, versus prior pricing of between one to two by year-end. This may seem like a small change, but when rates are so low, an 8 bps swing in year-end Fed funds rate expectations is meaningful in one day.

The good news, bad news paradox

The week is far from over. On Friday, the closely watched monthly payroll data is expected to deliver another Goldilocks report of 165,000 jobs added in July. An upside surprise may cause a sell-off if Fed rate cuts are priced out. Similarly, a big downside surprise could cause equities to rally. We saw this to a small degree on Thursday with the ISM indicator when a worse than expected reading of 51.2, the lowest in almost 3 years, gave equity markets a mild lift right after the release.

Bottom line

The 25 bps rate cut is neither a silver bullet nor the easy-money apocalypse that some pundits had prognosticated. In reality, 25 bps is likely to have little impact on the economy. Yet the Fed pivot, the miscommunications, the lack of cohesion on the part of Fed officials, all add to policy uncertainty, market volatility, and even threaten to erode the credibility that the Fed has so carefully constructed over many years. While markets are tinkering with their forecast of the Fed’s tinkering, none of it is addressing the big structural challenges of slowing growth and low global interest rates.