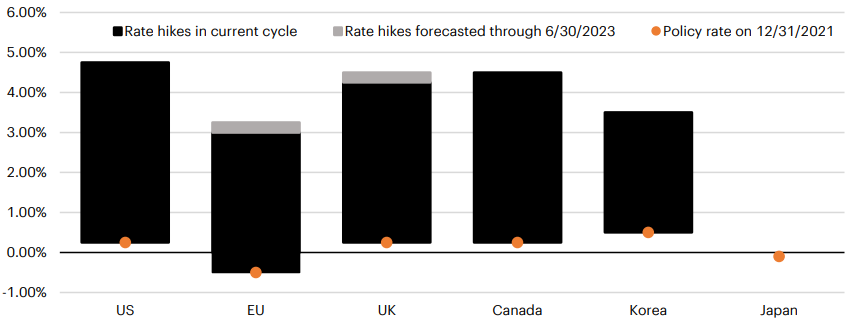

Central bank rate hikes through Q2 20231

As of March 24, 2023

Source: Bloomberg Finance L.P. As of March 24, 2023.

Last month’s rundown

Despite the banking system turmoil that ripped through global markets in March; the Fed, European Central Bank and Bank of England hiked rates 25bps, 50bps, and 25bps respectively last month. The banks led a concerted effort to defend the resiliency of the banking system while acknowledging that the full economic impacts were still unknown. It’s possible that the uncertainty surrounding the banking system may prompt the Fed and others to end their tightening cycles earlier than expected.

Bank of Korea and Bank of Canada took the lead in pausing their respective rate hike cycles,citing signs of cooling inflation and economic slow-down. For context, Bank of Korea was the first major central bank to begin hiking rates back in August 2021 while Bank of Canada has led one of the more aggressive tightening campaigns, hiking rates 425bps in nine months, on par with the Fed.

Meanwhile, Bank of Japan remains committed to ultra-easy policy despite the broader global tightening effort. After the surprise hawkish revision to its yield curve control policy in December, a tactic used to pin down borrowing rates, the bank left restrictions unchanged in January and March.

After roughly one year of coordinated central bank tightening, policy is beginning to diverge as some central banks continue in their hiking cycle while others reach their peak. Read the Global Central Bank Guide for a more in-depth analysis of where policy currently stands and what’s expected over the coming months.