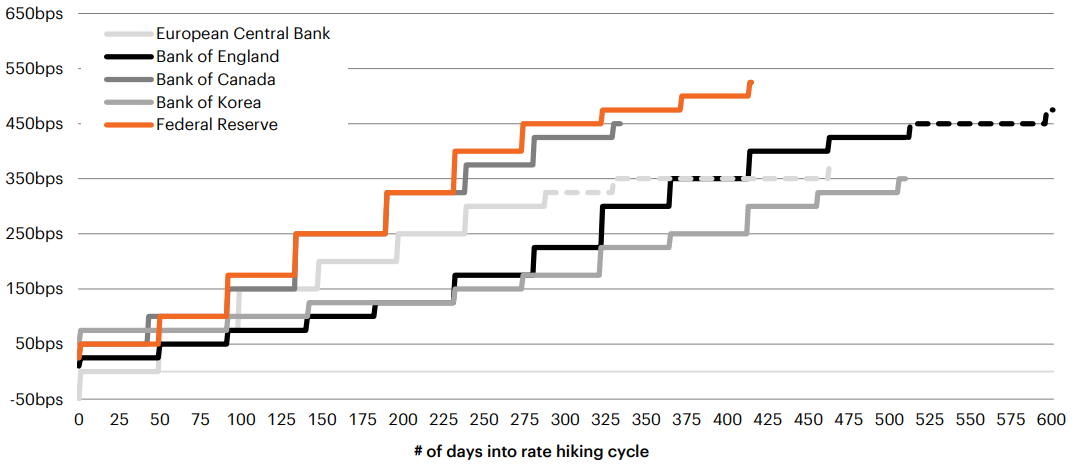

Central bank rate hike cycles (forward estimates implied by OIS curve)

Basis points of hikes to policy rate

Source: Bloomberg Finance L.P. As of May 4, 2023.

Last month’s rundown

The Federal Reserve, Bank of England and European Central Bank all hiked rates 25bps in May. The Fed, leading the most aggressive tightening campaign over the last year in terms of both size and speed of hikes, may have finally reached the end of the road. Investors expect the May hike to be the last of this cycle, after taking the policy rate up 500bps in just over a year. A combination of slowing growth, debt ceiling fears and uncertainty regarding regional bank stability has markets pricing in aggressive cuts, 50-75bps, from September through year-end.

Meanwhile markets have extended the timeline for both the Bank of England and the European Central Bank‘s tightening cycles over the last month as stronger-than-expected economic data in the U.K. and sticky inflation in Europe support both central banks taking rates higher.

Conversely, Bank of Canada and Bank of Korea continued to hold rates steady in April after pausing their hiking cycles in January, citing signs of cooling inflation and economic slow-down. There is the possibility that the Bank of Canada relaunches rate hikes in June after officials debated a rate hike in April due to reignited inflation concerns, although this is not market consensus.

The Bank of Japan‘s new Governor Kazuo Ueda started his term in April, but so far has not diverged from the dovish tone of his predecessor, remaining supportive of ultra-easy monetary policy and the country’s yield curve control policy. Despite bank officials signaling continued easing, markets anticipate a rate hike in Q4.

2023 is shaping up to be a pivotal year as central bank policy diverges and the economic impact of the historic tightening cycles sets in. We anticipate macro themes that dominated markets in 2022 and year-to-date to continue driving volatility through 2023 as policy unfolds. We also expect dispersion in policy and market cycles to create regional opportunities for active managers.