Inflation has been central to the market narrative for months, and last week it caused a sharp sell-off. With consumer prices surging and long-run inflation expectations at multiyear highs, we dissect whether rising inflation is technical, transient or structural. Investors will continue to digest the arc of inflation for the rest of 2021 with critical implications for policy as well as equity and fixed income markets.

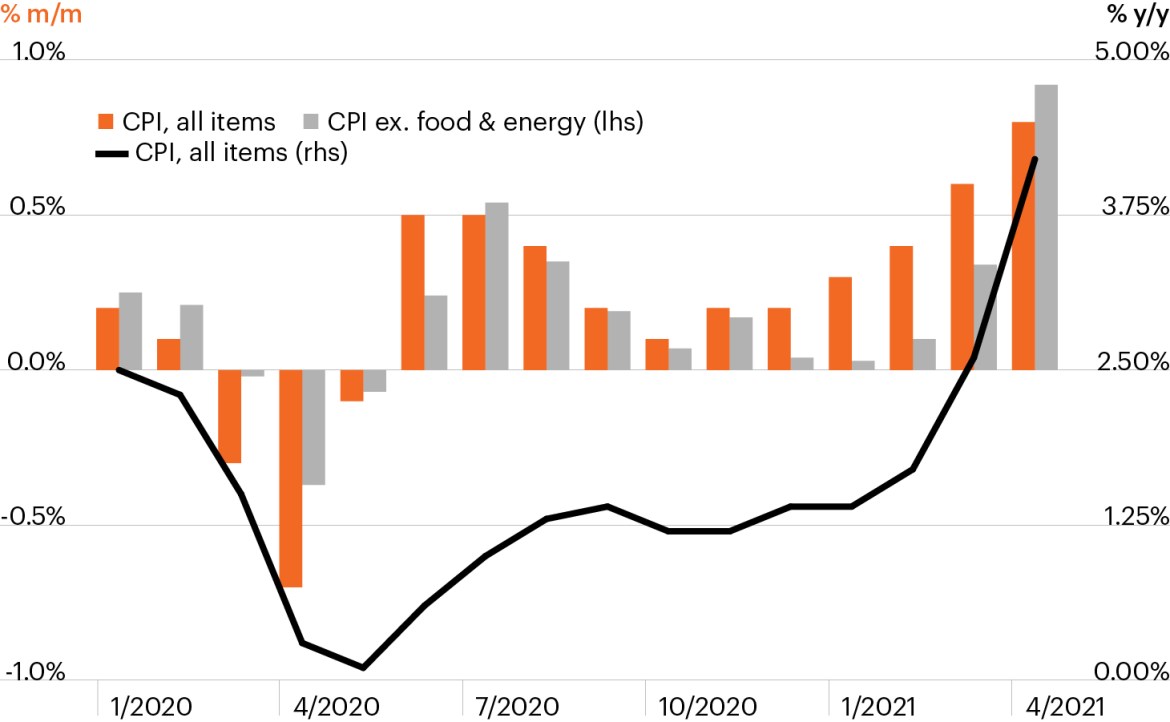

CPI surges in April

A jump in consumer prices was widely expected in April, but the 0.8% gain reported last Wednesday was far above the consensus expectation of 0.2%. This pushed consumer price inflation to 4.2% year over year, a 13-year high. When food and energy were excluded, core prices surged 0.9%, the highest monthly increase in 40 years. While the magnitude surprised, to some extent the details of the report were telegraphed well in advance. Reopening has caused prices for airplane tickets, hotels and rental cars (all travel-related services) to recover handily from sizable double-digit drops from March through May 2020. Used car and truck prices surged 10% in April as supply-side disruptions are limiting new car production and pushing people to buy previously owned cars. These four categories account for only 5% of the overall index but contributed about 50% of April’s jump in inflation.

Inflation roars back in April

Source: Bureau of Labor Statistics, as of May 13, 2021.

Which came first, inflation or inflation expectations?

Interestingly, last week’s sell-off began early in the week, before the CPI data was reported. Aside from the monthly inflation reports, markets have been closely following the steady increase in long-run inflation expectations, which have been rising for months and peaked on Wednesday at multiyear highs. Two often-watched measures, the 10-year breakeven and the 5-year, 5-year forward, both reflect market expectations of inflation in 10 years. Both measures have been rising for months, and have reached levels last seen in the early 2010s. Wednesday saw the market sell-off hit its low: The S&P 500 gave up -4.0% in the first three days of trading last week, and the NASDAQ dropped -5.24%, its worst 3-day sell-off since March.

Inflation expectations have hit multiyear highs

Source: Bloomberg Finance, L.P., as of May 13, 2021.

Wages enter the narrative

Average hourly earnings rose 0.7% in April, another sign that inflation dynamics may be shifting. I think of wages as the other side of the inflation coin — not included in personal consumption expenditures that the Fed targets, but an important part of how inflation connects to our economy. There are signs amid a growing labor supply-demand mismatch that employers are having to pay more for labor. In April, most job gains were in the leisure and hospitality industry (typically lower-paying jobs), and yet average hourly earnings rose significantly more than expected. Anecdotal evidence, for example from the Fed’s Beige Book, points to companies having trouble filling job openings because supplemental unemployment benefits and plentiful cash savings are limiting workers’ incentive to look for a job in the near term. There are also reports of companies now offering signing bonuses to encourage people to take jobs.

Wage inflation does not always lead to broader inflation. Indeed, the red-hot labor market of the last expansion saw wages steadily rise to close to 3.5%. One conundrum of the prior expansion — one the Fed readily admitted it didn’t fully understand as it walked back rate hikes in 2018 — was that higher wages did not feed through to broader consumer inflation. And yet higher wages are higher costs for companies at a time when other input costs are also rising. It remains to be seen if companies will pass along these higher costs or tolerate some erosion in their margins.

Is higher inflation technical, transient or structural?

This is the central question, because inflation is definitely on an upswing. There is a clear technical element: Massive lockdown-driven declines in March, April and May 2020 will cause the year-over-year calculation to surge in those same months this year. Some factors fueling CPI are also likely transient. The gain in used car prices is due to the semiconductor chip shortage creating a drag on new car production. Cash-rich consumers eager to buy a car as reopening intensifies have had to pivot to used cars, and prices reflect that increased demand. This particular supply chain could take some months to resolve, but the price jump is widely expected to prove transient. Finally, commodity prices continue to climb. There are outsized examples of this, like lumber prices, but the broader uptrend is notable, as the producer price index data showed for April.

The structural picture, for the first time in a long time, is more cloudy. Since the late 1980s, inflation in the U.S. has been trending lower. Globalization in the 1990s caused goods prices and wages to fall. Structurally low U.S. GDP growth has also reinforced a lower inflationary trend. Over decades, we have observed sliding inflation working itself into inflation expectations as exhibited by market measures, economic models, and consumer and business surveys. But our economy is in an unexpected place, and our recovery has only just begun. We may yet see changes to our economy that we are only beginning to understand, including shifts in labor and consumption trends that could change pricing power. Even if these changes help arrest structural disinflation, it would have enormous implications for investors.

It may not just be about inflation

Headlines early in the week linked the market decline to concerns about inflation, but there may be other dynamics at play. The consensus forecast is for Q2 GDP to grow 8.1%, the strongest quarter in 2021 (and likely for years to come). From here, growth is expected to remain strong but decelerate. That’s the word I keep returning to as I get more granular in my outlook for 2022: Deceleration. Deceleration of M2, which has surged. Deceleration of growth, of monetary policy support for our economy and, most likely, of earnings and revenue growth. To be clear, the consensus is for GDP growth of 4.0% in 2022, basically another blockbuster. But right now we are halfway through the second quarter — the fastest quarter for growth. This is it. Markets may be starting to grasp that the roaring 2021 party that has pushed valuations to stratospheric levels may be starting to wind down, albeit slowly and from a tremendous pace.

What does this mean for Fed policy?

For financial markets, connecting the dots from higher inflation to weaker equity market performance usually runs through Fed rate hike expectations. Higher inflation, in theory, means the Fed could raise rates, which would be negative for the economy and equities. Interestingly, last week Fed rate hike expectations barely budged. There is strong consensus that a Fed rate hike is years away, and the 3-year overnight index swap (OIS) rate, a fair proxy for long-run Fed funds expectations, has been little changed from last week. To me, this rightly reflects the fact that the Fed is more focused on the employment side of the equation; with the unemployment rate high and millions still out of work, the Fed is going to err on the side of support for the economy.

At some point, however, higher inflation will lead to higher long-term rates. We witnessed fixed income investors load up on duration for years as rates fell. But a similar case could be made for equity markets as interest rates fell below 2.00%. Low interest rates have supercharged valuations as the discount rate of future earnings has compressed. Concerns about rising long-term rates could be enough to weigh on equity markets, even without the imminent threat of Fed rate hikes.

What does this all mean for markets?

So far, U.S. Treasury yields have greeted this surge in long-run inflation expectations with a yawn. Over the last week, the 10-year Treasury has traded in a 10 bps range, from 1.60%–1.70%, comfortably within the slightly wider range of the last two months. Clearly, Fed asset purchases continue to hold long-term rates lower, and the Fed has signaled it isn’t likely to taper asset purchases until next year. The rise in inflation expectations has meant real rates — the long-run return on risk — have fallen even deeper into negative territory. The “lower for longer” theme has dominated the income side of investments for years, and the Barclays Agg just finished its worst quarter since 1981. For income-seeking investors, finding a way to manage this low-yield landscape is going to be a necessity for years.

Key takeaway

Inflation is rising. Technical factors are certainly at play and supply-side disruptions are contributing, although so far they seem temporary. But other factors, including higher input prices and commodity prices as well as early signs of some upward wage pressure, could create a “perfect storm” to offset the structural forces that have pushed inflation lower for decades.

Long-run inflation expectations have moved enough to get the market’s attention, and rightly so. Inflation is one of the obvious threats to our nascent recovery. An overheating economy is fertile ground for a sustained acceleration in inflation, which could force policymakers to slow the economy down — a story which rarely has a happy ending. We are far away from the sustained higher inflationary data of that scenario. For now, inflation concerns seem to be dark clouds that roll in but quickly recede. Equity markets are hovering near record highs, after all, and finished strong on Thursday and Friday. But our economy is hardly facing a normal early expansion. If planted in enough places, inflation could grow faster than we think.