The global financial market is transitioning away from LIBOR – a momentous prospect that has raised questions, challenges and concerns. We look at the basics of the current LIBOR rate and usage, the steps underway to introduce a replacement, and what comes next. At FS Investments, we have set up a task force to ensure a smooth transition and see a major disruption as unlikely, in-house or globally. That said, a lot of runway needs to be covered by the end of 2021 to achieve liftoff of a new overnight and term funding regime.

LIBOR 101

I often compare the overnight funding market to your circulatory system. It reaches virtually everywhere. We often take it for granted. But if something small goes wrong, it escalates to big problems very quickly. And yet this critical but often overlooked part of the market is undergoing major changes. It is hard to overemphasize the reach of LIBOR, which is tied to an estimated $400 trillion (or around 5x global GDP) worth of consumer and commercial transactions, including credit cards, auto loans, mortgages and a long list of derivatives.1

First, a quick refresher on LIBOR, which stands for the London Interbank Offered Rate. LIBOR approximates the rate at which major global banks can lend to one another, typically overnight or for short-term loans. The benchmark rate is determined by a daily survey of 11–16 large, international banks.2 Each day the banks make submissions estimating how much they would charge other banks for short-term loans across a range of maturities from 1 day to 12 months. Since the mid-1980s when the British Bankers’ Association formally established governance over this rate, it has become the global benchmark and base rate for a wide variety of financial transactions.

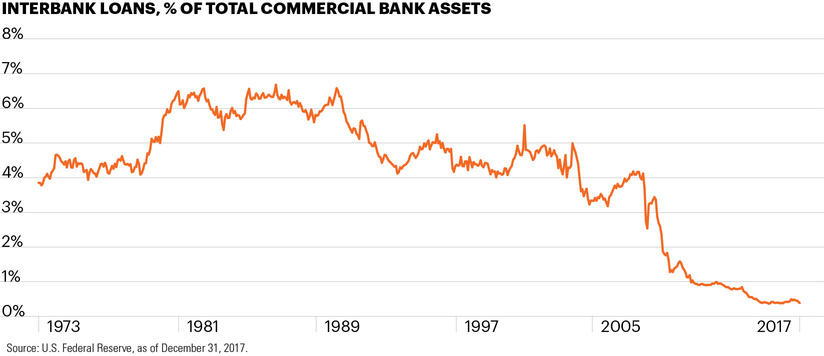

Yet as markets have evolved, LIBOR has become problematic, necessitating a change. Over the decades, market activity has moved away from interbank lending, and the volume of execution has declined appreciably. Indeed, many banks in the LIBOR survey aren’t even undertaking these transactions, and the number of banks willing to participate in the survey has fallen. Instead, the majority of submissions are based upon banks’ models, not actual transactions. This means the rate has become increasingly disconnected from the market and vulnerable to manipulation. In fact, there was evidence of bank wrongdoing with regard to LIBOR submissions during the financial crisis.

Leaving LIBOR: A lot is at stake

In light of the manipulation and disconnect from freely determined markets, the decision was made to transition away from LIBOR by the end of 2021.3 Moving away from such a pervasively used benchmark rate is an enormous undertaking, however. Indeed, it is hard to overestimate the stakeholders and financial reach of LIBOR-related products.

For consumers, adjustable-rate mortgages (around half of all U.S. mortgages) are benchmarked to a LIBOR rate, as are many floating rate student loans and even credit card debt. Large companies encounter LIBOR almost daily through their daily liquidity management, and virtually any corporate debt issuance with a floating rate coupon is based on LIBOR, including most bank loans. For financial markets at large, LIBOR is a common benchmark for floating rate notes, a basic and common tool to manage interest rate risk.

Suddenly, at the dawn of 2020, this retooling of the central plumbing of the financial system is looming large. The progress has been significant, and yet given the scope of our economy’s interaction with LIBOR, the stakes are high to ensure a smooth transition, and significantly more work remains.

Given the magnitude of the task ahead, a committee called the Alternative Reference Rates Committee (ARRC) was created to help guide markets through the transition in the U.S. This committee includes participants from many related entities, including the private sector, the Federal Reserve system and other banking and financial regulators, and is working in coordination with oversight councils toward the goal of financial stability, above all else. This group is focused on U.S. dollar-denominated LIBOR products, which are estimated around $200 trillion. Other countries have created their own transition committees and operations, mainly in the financial centers of the U.K., Europe and Japan.

The road ahead

There are two key elements to successfully transitioning away from LIBOR with minimal disruption, and there is good news on both fronts.

- The first is to create a replacement rate.

- The second is to create a road map for existing contracts that include LIBOR and draw a clear and consistent framework for future contract language.

The replacements: Meet SOFR

A replacement has yet to be officially crowned, but there is widespread agreement that in the U.S. the replacement rate will be the secured overnight funding rate (SOFR). SOFR satisfies several important criteria, namely that it is completely transaction based, has broad representation in various overnight Treasury (or secured) repo markets, and therefore better represents the cost of secured lending and borrowing in the overnight market.

The SOFR market is still relatively nascent, but daily transaction volume has regularly surpassed $1 trillion and is growing rapidly. Important thresholds remain, however. Currently there is no yield curve for SOFR, meaning 3-month SOFR is calculated as an average look-back, versus the 3-month LIBOR, which is a forward-looking rate. There is widespread expectation that this curve will develop, however. There are other important noteworthy differences between SOFR and LIBOR that we describe in detail in our report, “SOFR and the path forward.”

Creating a roadmap

Financial products tied to LIBOR as a benchmark have contractual language that frames out the specifics of which LIBOR tenor (or maturity) and a stated spread above the benchmark, reset specifications and other fine print. Existing contracts typically include fallback language in case LIBOR is not available. But for most legacy contracts that predate this potential transition, the fallback language is meant to address a temporary interruption of LIBOR, not the permanent cessation that is being planned.

In other words, trillions of dollars of financial contracts will have to be amended or updated with adequate legal language to deal with the transition and the fact that LIBOR is going away. Much of ARRC’s work is in recommending language to make this process easier, but given the variety of related products, it is a complex task.

Broadly speaking, new or amended fallback language will need to deal with three major issues:

- When will the reference rate of a given financial security shift away from LIBOR? For example, the language must specify “triggers” – events that will cause contracts to switch from LIBOR to SOFR. Ideally these transitions would happen before a drop-dead date of December 31, 2021. Will markets migrate in unison, or will the shift be more fragmented?

- What will the new rate be? Market preference may be coalescing around a term SOFR rate as a LIBOR replacement, but that rate is not yet available. Should the term rate not be ready at the time of the trigger, language must deal with a “waterfall” of backup rates that will determine how the benchmark will be calculated.

- How will differences between LIBOR and the new rate be dealt with? SOFR is a risk-free rate, while LIBOR includes credit and liquidity risk. How will the new rate be adjusted to account for this difference? There will likely need to be some additional spread added to SOFR to compensate lenders.

ARRC has released suggested language for cash products, while other official bodies like the ISDA – a trade organization for OTC derivatives markets – will suggest language for derivatives contracts. While these suggested changes to legal documentation are likely to be broadly adopted, they are suggestions and therefore completely voluntary. Solutions to each of these issues will require a significant joint effort from both the public and private sectors.

FS Investments LIBOR transition task force

Given that many of our investment funds include various forms of floating rate debt, we are well versed in financial products benchmarked to LIBOR. In preparation for this broader transition, we have created a task force with stakeholders from research, compliance, accounting, finance, capital markets, legal and investment management. We are actively analyzing how the global transition away from LIBOR will impact our own portfolio investments and broader financial market conditions. We are confident we will have appropriate fallback provisions in place well ahead of the end of 2021.

More broadly, there are multiple committees around the globe working within each financial center, as well as coordinated work by central banks, to make sure adequate plans are in place to prepare for the expected end of LIBOR. There is work to be done, but as of now, the development of the replacement risk-free rates is proceeding according to ARRC’s plan, and fallback provisions are being widely developed. We don’t expect a broad financial disruption, but given the enormity of the task, it will bear close watching in the coming year.