Key takeaways

- The middle market—which comprises roughly 200,000 companies at the core of the U.S. economy—remains fundamentally sound, with strong revenue growth and rising investment appetite.

- Hiring looks set to moderate in some sectors, but improving productivity should act as an offset.

The U.S. middle market—in this context, referring to the roughly 200,000 companies in the U.S. that make between $10 million and $1 billion in revenue annually—is the lifeblood of the U.S. economy. For private alternative strategies, its health is critical—to the PE investors that own these companies, the private credit firms that lend to them and the real estate operators that lease to them. In our review of middle market fundamentals, we observe that this segment of the market is not only surviving the higher interest rate environment but also thriving.

Revenue for middle market firms grew by 12.9% in the year ending June 30, the strongest pace of growth since the beginning of our data set. This is even more impressive considering revenue growth has remained nearly constant since Q4 2021, a period during which CPI inflation declined from a yearly pace of 7% to 2.5% today. Said differently, strong revenue growth in the U.S. middle market has increasingly come from real unit sales growth rather than price increases. Compare this to the S&P 500 ex-Magnificent 7, which grew revenue at just a 4.5% pace over the past year, and it becomes clear where U.S. economic resilience has accrued.

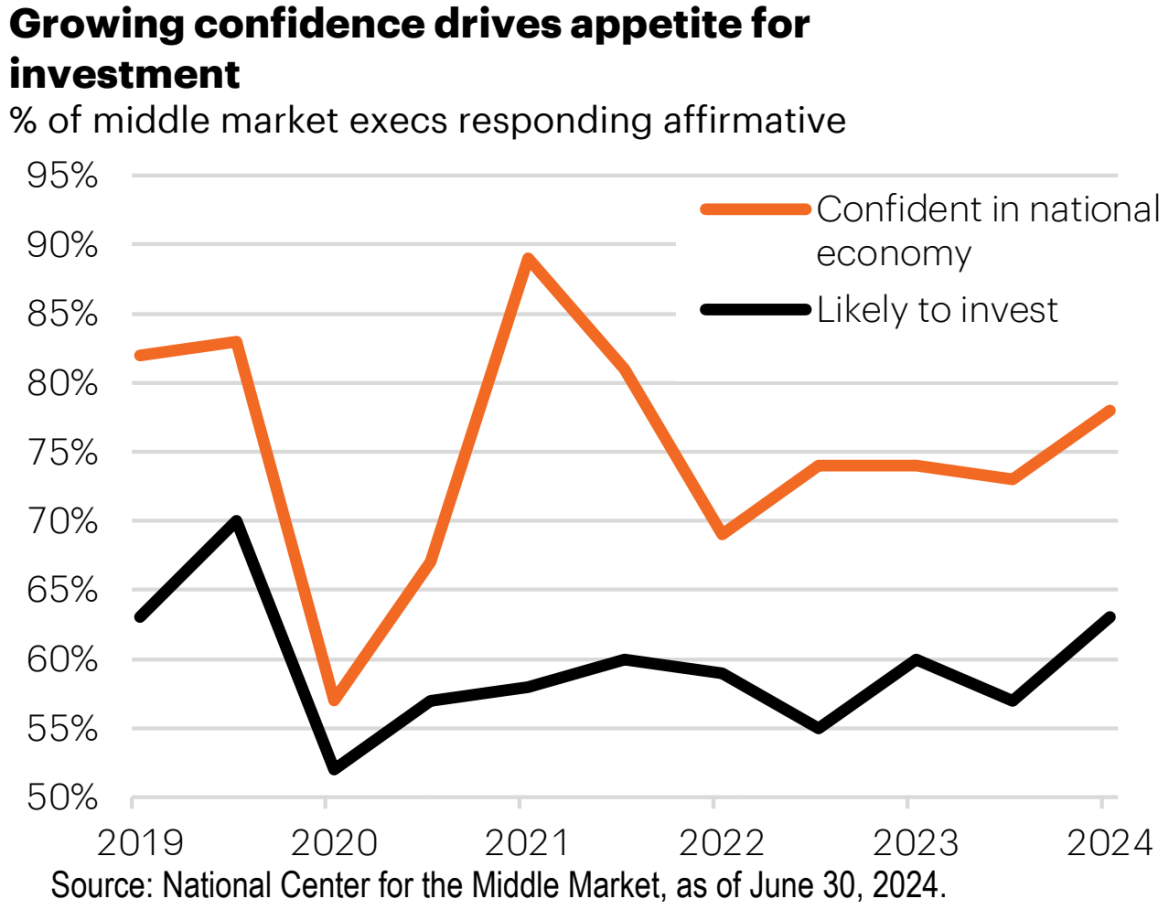

Financial strength has led to an appetite among middle market firms to invest. Nearly two-thirds of firms report plans to invest an incremental dollar of sales rather than save it, the highest number since the pandemic. Hiring remains solid but cautious; companies report robust hiring intentions, but the number of job openings for firms with 250–5,000 employees has fallen by almost 50% since its peak in late 2021, though layoffs are near-nonexistent. In all, more tepid hiring combined with rising capital investment has resulted in productivity growth of 2.6% (compared to the pre-COVID level of just 0.7%).

Executives at middle market firms are increasingly confident in the resilience of the U.S. economy. These firms reap an average of 80% of sales domestically but have been consistently bearish on the national economy. One survey shows confidence in the U.S. economy among middle market executives finally turning higher at midyear 2024 to a 30-month high, likely a reflection in part of expected Fed rate cuts.

Elevated rates undoubtedly remain a challenge, though their moderation since late spring has provided a much-needed boost for business sentiment. Core drivers of revenue growth for middle market companies—the U.S. consumer and capital investment by large corporations—remain intact. And middle market firms’ plans for capital investment and expansion signal a confidence in the future that will require significant capital from outside investors to finance.