Many energy- and income-focused investors have long turned to master limited partnerships (MLPs) for their attractive yields and tax-advantaged structure. The fall in oil prices from 2014–2016, however, ushered in a period of corporate and organizational restructurings that we believe fundamentally altered the midstream sector and how investors can best access the opportunity within energy infrastructure.

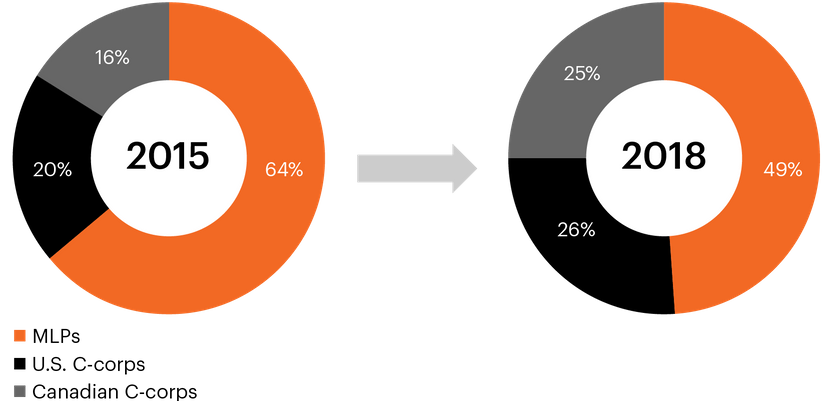

While MLPs remain an integral part of the midstream landscape, they represent less than half of the available investment universe compared to two-thirds of the sector just three years ago.¹ C-corporations now comprise the majority of midstream assets.

How do these changes impact investors?

The FS Investments Research team provides perspective on how the evolution of the midstream sector has created both challenges and investment opportunities for investors in a report that:

- Offers a refresh on the MLP structure and growth of the midstream sector

- Articulates the impact of the 2014–2016 commodity cycle on the midstream sector

- Explains how investors can best position their portfolios to take advantage of these changes

Midstream composition by structure type, 2015 vs. 2018¹