Collateralized loan obligations (CLOs) were back in the spotlight for much of 2020 as, once again, many pundits called for their demise. But for the second time in as many major market crises, CLOs weathered the storm. As markets globally continue to heal from the pandemic, we still see opportunity in this structured credit investment.

CLOs, which are investments backed by pools of corporate loans, sold off alongside broader markets in February and March 2020. Many pointed fingers at the time, rehashing old arguments equating CLOs with other structured credit investments that played a lead role in the 2008 financial crisis: mortgage-backed securities (MBS) and other collateralized debt obligations (CDOs). Shortly thereafter, we wrote about the merits we saw in CLOs in our report, A CLO-ser look at structured products. We highlighted how CLOs are specifically designed for environments like we saw last March. They are rarely forced sellers and have implicit and explicit investor protection mechanisms. Furthermore, their underlying holdings are transparent to investors and the CLO itself is actively managed by a manager incentivized based on the performance of the deal.

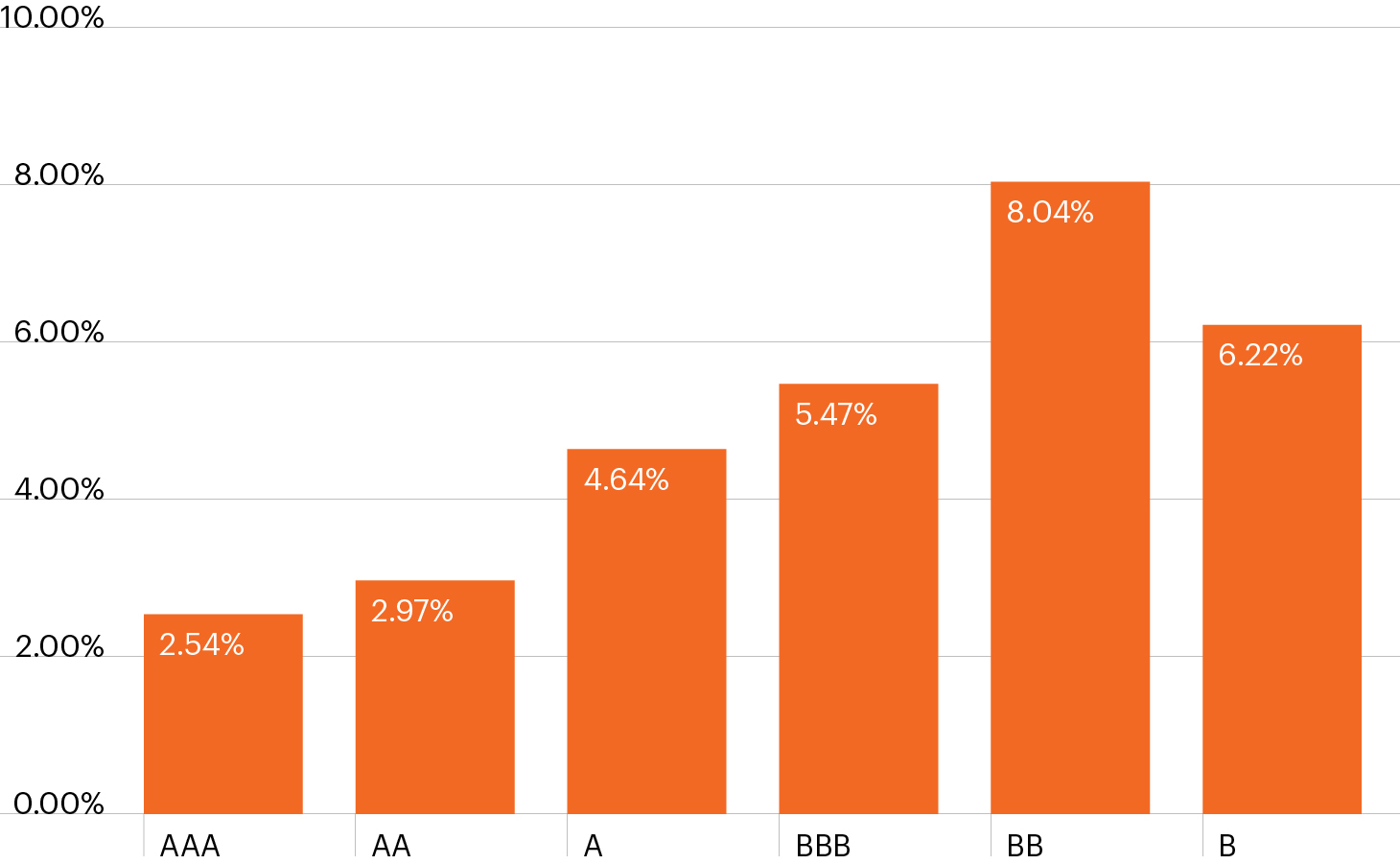

Since then, CLOs have staged a remarkable recovery. Each tranche ended the year firmly in positive territory and not a single CLO defaulted.

CLO returns were strong across the capital stack in 2020

Source: J.P. Morgan CLOIE Index, January 1, 2020–December 31, 2020.

We have a generally constructive view on credit markets for the remainder of 2021 given an improving economic backdrop, widespread vaccine distribution and supportive technicals. While credit spreads are tight, we firmly believe active managers can find opportunities for excess return this year. CLOs are one area where we continue to see positive momentum.

Key takeaways

- CLOs performed well throughout 2020 but in our view remain attractive in 2021.

- History tells us the spread between CLOs and comparably rated corporates may have room to tighten.

- Beyond these relative value assumptions, experienced CLO investors may find opportunity in CLO refinancings and resets.