Key Takeaways

- Banks’ new role as partners to private credit is emerging amid headwinds in the banking sector.

- Numerous banks have struck origination partnerships as a capital-friendly way to keep core customers.

- Increasingly, banks are looking to offload risk, either via significant risk transfers (SRTs) or outright sales.

Much ink has been spilled about the changing role of banks in the U.S. financial system over the past four decades. Once the dominant principal lenders in business, consumer and real estate credit, banks have shifted their activities away from warehousing risk and toward disseminating it. Regulation has played a crucial role in this flip, and with Basel III Endgame on the doorstep, we see the role of banks changing again.

Leverage and risk-based capital rules have made it increasingly challenging for banks to add incremental risk to their balance sheets. This has led many toward the “intermediary” role in which they earn a fee for originating loans and bringing in outside investors via syndications and securitizations. Now, banks are being forced to reckon with the rapid growth of private credit while hamstrung by cyclical business pressures and pending regulation. The outcome thus far has been for banks to utilize private credit firms as both partners and counter parties.

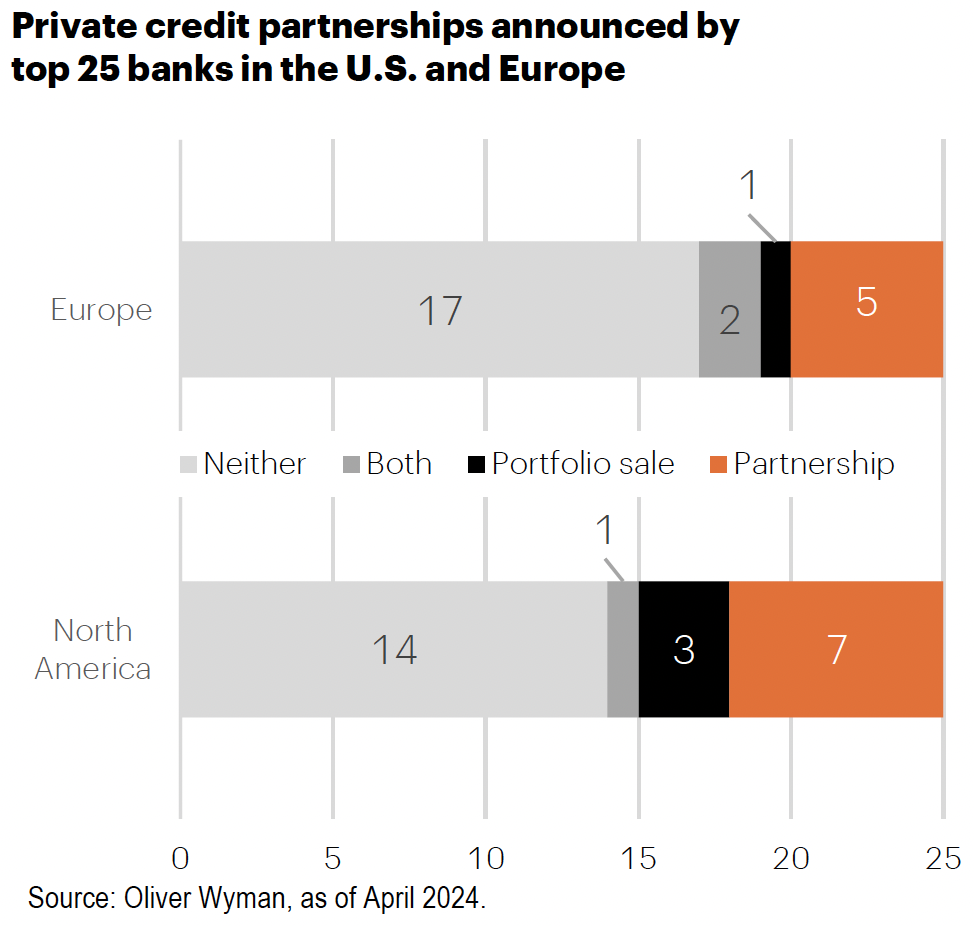

We count at least 15 recently announced private credit partnerships among the largest North American and European banks, including most recently a $25 billion tie-up between Apollo and Citi These agreements give banks access to private credit capital, and private credit firms access to bank relationships. These structures allow banks another mode of collecting fees without materially increasing their risk-weighted asset base. Banks have also increased their lending to nonbanks such as private credit funds, in essence taking a super-senior position in the loans they previously would have funded wholly.

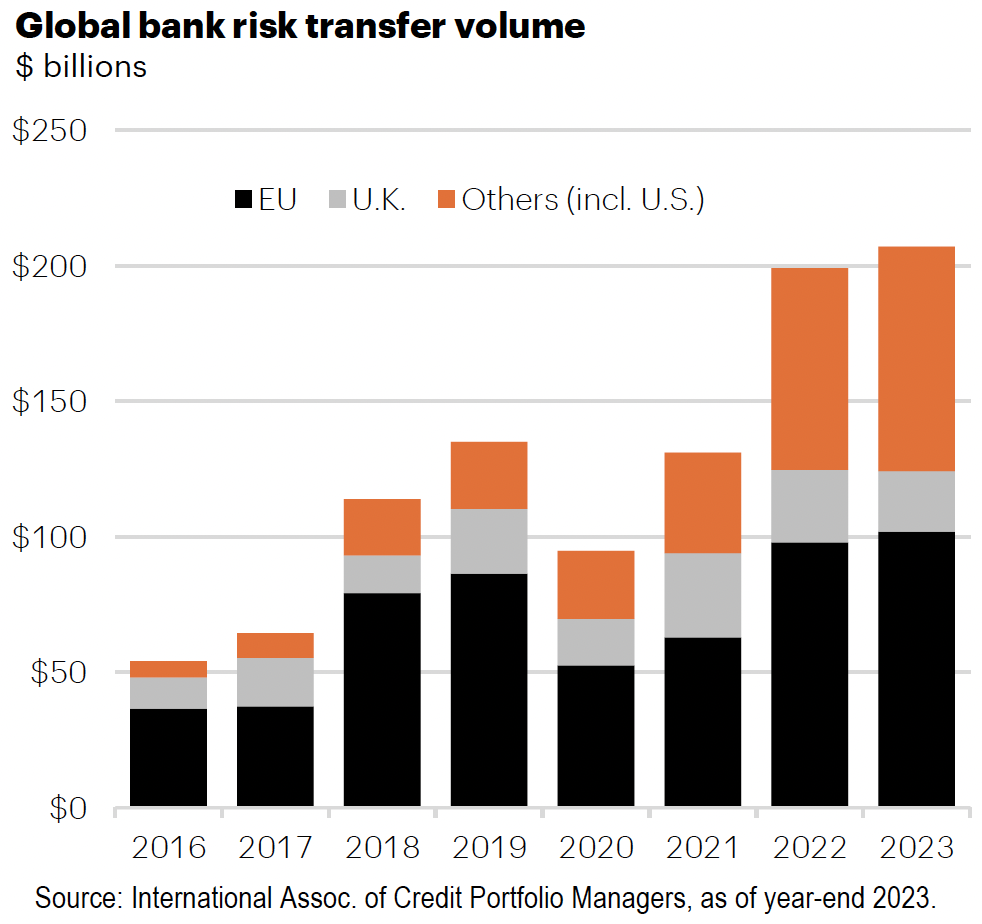

We also see banks and private credit engaging as counterparties when banks are seeking to reduce exposure. This may come via outright loan sales to private lenders, or so-called credit risk transfers, in which a portion of a loan portfolio’s economics are sold to third-party investors. This market, already quite large in Europe, is rapidly gaining prominence in the U.S., to the tune of a 200% increase in just three years, and we expect the market to grow further via the imposition of Basel III Endgame capital requirements.

Clearly, the challenges faced by banks will continue to drive opportunity in private credit in multiple ways. From partnerships to financing to accessing opportunities on bank balance sheets, private lenders look set to capitalize. Banks will remain a crucial cog in the financial system, but their role appears to be shifting—again.