Key takeaways

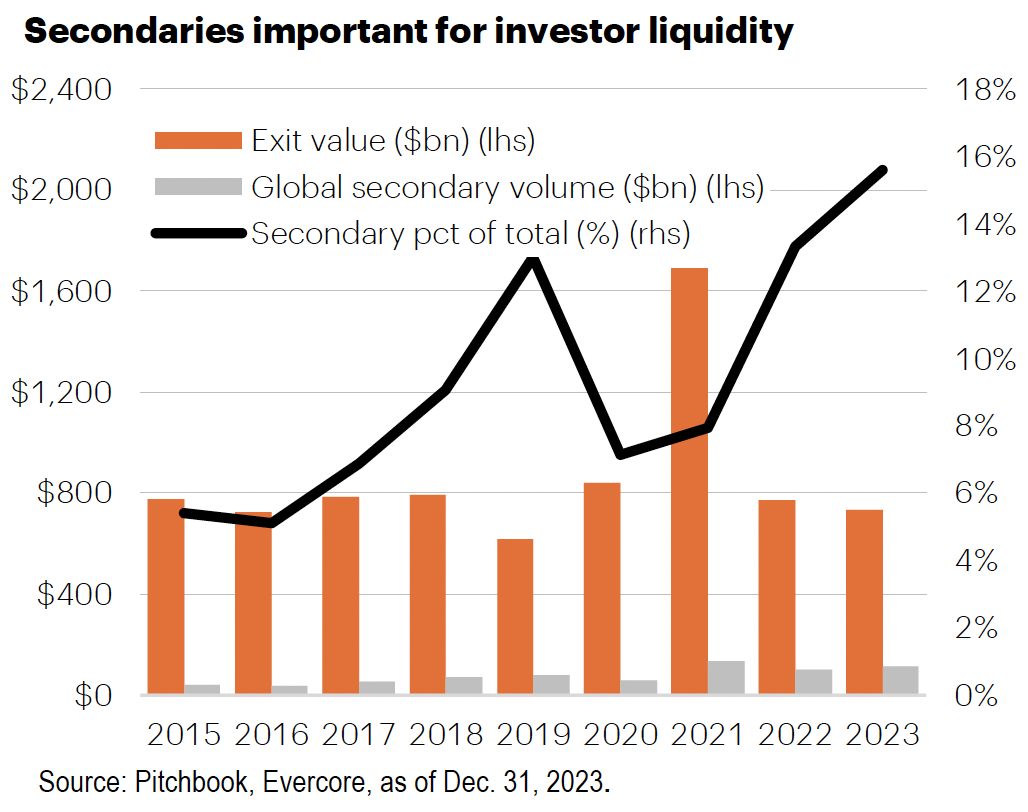

- Given the volume of exits in the queue, secondaries are likely to play an increasingly vital role.

- Relative to primary funds, the secondary market may be undercapitalization relative to supply.

- Secondaries investors may benefit from a growing opportunity set of favorable buy-side dynamics.

The secondary market for private equity plays an increasingly vital role in facilitating activity from primary vehicles. From 2013 to 2023, secondary market transaction volumes grew from $26 billion to $114 billion, increasing at a CAGR of 16%.

Historically, LP-led deals comprised the bulk of secondary transactions, accounting for more than two-thirds of volume each year until 2020. LPs have utilized the secondary market to obtain liquidity for a variety of reasons, one of which being to clean up older vintages plagued with laggards that required LPs to accept deep discounts. However, we now see LPs utilizing the secondary market more tactically, selling newer vintages. From 2015 to 2022, the average age of LP funds sold was 8.7 years, but through the first half of 2024, that number had declined to 6.4 years. This may leave more upside for prospective buyers as transacted funds remain earlier in the value creation life cycle.

Now, the fastest growing segment of the secondary market is GP-led secondaries, where volume has grown at a CAGR of 26% over the past 10 years, climbing to $51 billion in 2023.

Despite growing interest from a wide array of investors, in our view, the secondary market remains undercapitalized relative to current and prospective transaction volumes. As of June 30, 2024, dry powder for secondaries-focused strategies amounted to $189 billion, roughly equal to the $186billion of transaction volume over the past one-and-a-half years. Another way to evaluate the adequacy of secondary market capacity is dry powder relative to the unrealized value of primary PE. On this basis, global secondary market dry powder is just 3.2% of unrealized value, which is in line with history. However, simply staying on par with history may be inadequate. When considering secondaries in the broader context of how PE investors get liquidity (i.e., exits and secondaries), secondaries are playing an increasing role.

In looking at prospective deal volume, we consider the age of funds most commonly transacted in the secondary market combined with the exit rate of funds within that target age range. In H1 2024, the leading cohort of vintages transacted were from 2016–2018 (45%) followed by vintages 2019–2021 (29%), while just 26% of volume came from all vintages pre-2016. More generally, we note that the typical age of funds in which a secondary transaction was executed is roughly six years. This means that vintages 2018–2022, where deal volume was strong but decay rates have been the lowest, are prime candidates for secondaries.

For investors, this provides a growing opportunity set for secondaries-focused funds to target. Prospective deal flow appears sizable relative to existing dry powder, potentially offering a favorable dynamic for well-resourced buyers.