In our 5 for ’23 on corporate credit markets released in late 2022, we called for credit to outperform equities this year. While that call has been wrong so far, equities and risk assets more broadly have performed far better than we expected year to date. However, perhaps the tide has started to turn in the third quarter. Good news has become bad news, with economic outperformance and an increasing chance of a soft landing, resulting in reduced expectations for Fed cuts in 2024, the possibility for another hike in 2023 and materially higher 10-year Treasury rates over the course of the quarter. While higher rates are often bad news for fixed income, they are also becoming a negative for equities as they were throughout last year. Against this backdrop, credit markets have started to outperform, but for a different reason than we anticipated.

Key takeaways

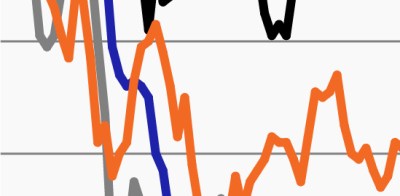

- Rising stock/bond correlations punished investors in 2022, providing little relief for a ‘diversified’ 60/40 portfolio. As the third quarter ends, correlations have again increased to nearly the same peak witnessed in 2022, a point we highlighted recently. However, this issue is most impactful for higher duration fixed income investments and an S&P 500 that has become increasingly concentrated in large cap, higher duration tech stocks. Corporate credit, and specifically high yield, loans and CLOs, benefit from either low duration or nearly no duration. The excess spread related to credit risk in high yield has historically protected this fixed rate market from moves in interest rates. In fact, prior to 2022, the actual measured duration of high yield was negative, meaning rising rates tended to be positive for returns. Why does this occur? In our view, rising rates tend to be correlated with a strengthening in the underlying economy, which reduces credit risk and decreases the spread that high yield trades at relative to Treasuries. Quarter-to-date returns reflect this once again. The S&P 500 is up 0.35% through September 15, while high yield, loans and CLOs are up 1.6%, 3.4% and 3.74%, respectively.

- Credit market returns are also benefiting directly from higher yields. Like a quarter ago, loan and CLO markets remain in their top decile of historical attractiveness from a yield perspective, despite recent spread tightening. Even for high yield, where spreads have also declined, yields have stayed elevated given rising Treasury rates, and remain in their second quartile of historical attractiveness. We believe this provides further support to credit markets compared to equities, where price-to-earning (P/E) ratios are in their priciest quintile relative to history.

- There is little material difference in the data to suggest altering our view about Q4 performance continuing at or above the level of income return in credit markets. Underpinning our call last quarter was the view that macro conditions and corporate fundamentals would remain supportive. Near the end of Q3, the Atlanta Fed GDPNow forecast is at 4.9% and the Blue Chip consensus is around 3%. If these forecasts prove to be generally accurate, Q4 will be starting with steady growth and an economy that remains on solid footing, even if the forecast into 2024 looks murky.

Read the complete Q4 2023 corporate credit outlook to learn more.