Heading out of 2017, the U.S. economy was gaining solid momentum while foreign economic growth surprised to the upside. So it’s perhaps unsurprising that, as we’ve headed into 2018, our economy appears to be growing meaningfully above its potential. Against this backdrop of robust growth, we present our core macro themes for 2018 and discuss how, paradoxically, booming economic growth could challenge investors. Higher growth is more likely to expose the economy and markets to substantially higher volatility – something that has already caught investors by surprise in 2018.

A round of applause for 2017

Before discussing 2018, we need to take inventory on all that went right in 2017 – and what a year it was! The year started with political and policy uncertainties surrounding a variety of issues including possible trade wars, EU elections, geopolitical unrest and global central bank policies. 2017 sidestepped (or maybe barreled through) each of these potential policy headwinds. The Economic Policy Uncertainty Index for the U.S. started 2017 at 123.1 but ended at 94.6.

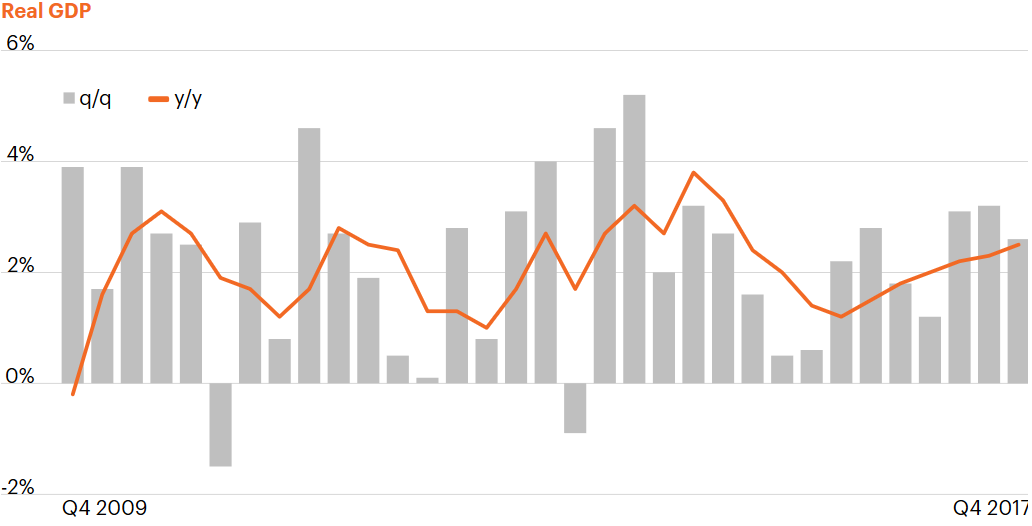

We also left 2017 with improved growth momentum, up from 1.8% at the end of 2016 to 2.5% year-over-year in Q4 2017.¹ Growth in the rest of the world was sharply better than expected. A year ago, the IMF forecasted EU growth of 1.6% and Japanese growth of 0.8%.² We now know growth soared to 2.4% and 1.8%, respectively – an astonishing upside surprise.³ Oil prices rose 12.5% to over $60/bbl, taking advantage of solid global growth as well as supply cuts finally coming to fruition.

Strong growth momentum in 2017

Source: Bureau of Economic Analysis, FS Investments.

Finally, inflation unexpectedly decelerated. Yet instead of being taken as a sign of economic stagnation, lower inflation held interest rates down, which helped create an environment of favorable monetary conditions and boosted asset prices. All of this resulted in what was truly a “Goldilocks” environment for investors.

Three key macroeconomic themes for 2018

All of these positive tailwinds have left us with rosy expectations going into 2018. Yet we need to counterbalance the wave of good economic news that is accelerating growth with some reflection on the structural long-term challenges facing growth. Economists, and policymakers, monitor not just economic growth, but the underlying potential growth of the economy. Potential growth is the long-run equilibrium level of growth that corresponds to a steady unemployment rate and does not spark (or depress) inflation. This underlying trend growth rate has fallen over the last several decades as demographic changes have caused labor force growth to slow. Potential growth has been reduced further by weak productivity growth, which started trending lower in 2003. The Fed currently estimates potential growth at 1.8%, a notable slowdown from 2011 when the Fed estimated trend growth of 2.4%–2.7%.⁴,⁵

Trends in potential growth may seem academic, even abstract, but are highly relevant for investors. A lower potential growth rate means that even strong economic growth will likely be slower than in past decades. Expansions in the 1980s and 1990s saw GDP average 3.5%.⁶ Since 2010, growth has averaged only 2.2%. Put another way, a rate of growth that was considered lackluster in prior expansions now could cause the economy to overheat. This is particularly important as the economic expansion matures. The Fed has a dual mandate of maintaining full employment and ensuring long-run price stability. The unemployment rate is 4.1%, and its pace of decline does not seem to be slowing. So far, the Fed has been cautious in the face of what is arguably a tight labor market, mostly because inflationary pressures dissipated in 2017, and upward pressure on wages has yet to fully materialize. In the end, how the economy is growing relative to its underlying potential has significant implications for Fed policy.

Given this context, we see three overarching macroeconomic themes in this ninth year of the economic expansion.

1. We expect above-trend growth to continue in 2018. Many of the factors causing positive momentum are set to remain, or even amplify, throughout this year. Prospects for the consumer are buoyed by a strong labor market, significant wealth gains in 2017 and signs that wage growth may finally be rising. Consumer confidence remains near the high point for this expansion. Business investment, which has lagged so far during this business cycle, looks increasingly likely to gain traction in the wake of the Tax Cuts and Jobs Act. Business sentiment, particularly manufacturing sentiment, is close to its highest level in seven years.⁷ For 2018, the Fed expects growth of 2.2%–2.6%, a range that would be slightly higher than the current expansion’s average, and significantly above the underlying potential growth.

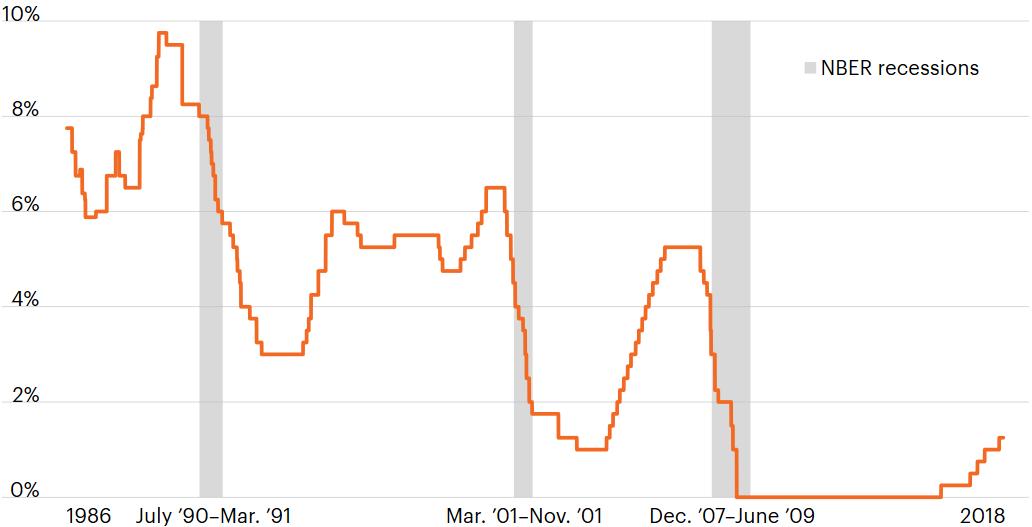

2. Accelerated growth makes us vulnerable to volatility. When growth rates are this far ahead of potential growth, there is a real risk of a significant rise in volatility. A plummeting unemployment rate, which is already below what the Fed considers the “natural rate” of unemployment, along with surging growth could push the Fed to raise interest rates more aggressively than markets currently expect. This classic Fed “overshoot” has been a precursor to the last four significant market corrections (and the last three recessions). If wages start to rise rapidly, the sleeping beast that is inflation could rear its head, disrupting equity markets and triggering a bear market in fixed income. Debt levels across the spectrum, from households to the U.S. government, are elevated, and the tie between leverage and volatility is strong. 2017 was a year of historically low financial market volatility. The VIX, a measure of equity market volatility, reached an all-time low during the year. In short, volatility could continue to emerge from a number of places.

Fed funds rate hike cycles during expansions

Sources: Federal Reserve, NBER, Macrobond. As of February 1, 2018.

3. Finding income will continue to challenge investors. Long-term U.S. interest rates are likely to remain low by virtually any historic comparison. 2018 has started with a move higher in the 10-year Treasury. However, when compared to where rates were during prior expansions, they are still exceptionally low.⁸ Strong growth is applying some upward pressure on interest rates, but there are offsetting factors that will likely limit how high U.S. rates will go (absent an inflationary wildfire, which would bring its own plethora of problems for investors). As the European and Japanese central banks actively pursue quantitative easing policies, interest rates in the rest of the developed world remain depressed. With competing government securities yielding little, there is a hypothetical cap on how high U.S. rates could drift. Short-term rates have begun to rise, with the 2-year Treasury breaching 2.00% for the first time since 2008, but this has largely resulted in a flatter yield curve. This expansion is on track to be the second longest since WWII, yet the federal funds rate is at only 1.25%, compared to over 5% at this late stage of most previous expansions. Against this backdrop, investors will likely continue to struggle to find income.

Enjoy the growth but position for volatility

The structural challenges of low productivity and low labor force growth will continue to push down potential growth. That being said, growth has dislocated from its potential for long periods in the past – there’s no telling when it may revert to trend. Cyclical momentum is teeing up 2018 for growth that is well above trend, or potential. This opens up the possibility for volatility as the number one risk for the year. As we have seen, volatility can spike very quickly and without notice, so it is critically important that investors become proactive and prepare for it rather than react after it hits.

We will be monitoring a great deal of topics and indicators throughout the year, but we will keep these three themes top of mind: economic growth sustained above trend, the potential for volatility to continue and the income challenge that investors can’t seem to shake.