The U.S. economy is slowing. The blistering pace of 2.9% growth in 2018 was unsustainable, and a deceleration closer to our potential growth rate around 2.0% has been widely expected. But softening data YTD and yield curve inversion have raised concerns that growth could slow more sharply than expected, or even contract, resulting in a recession. The speed, depth and anatomy of the slowdown now become the focus for markets.

We are not forecasting a recession, and still believe growth around 2% is the most likely scenario for 2019. However, with the rest of the world slowing meaningfully and uncertainties creeping in, risks to this forecast are accumulating. If history is any guide, investors should be in for a bumpy ride as economic growth cools.

Fueled by tax reform and increased fiscal spending, economic growth accelerated in each of the past three years. GDP rose from well below the Fed’s estimate of long-run potential (1.9%) in 2016 to well above it in 2017 and 2018. The Conference Board expects GDP to increase at 2.6% in 2019 and 2.0% in 2020 while the Fed projects slower growth of 2.1% and 1.9%, respectively.1,2 In other words, growth is expected to slow, but not crash.

The CEO Economic Outlook Index adds a layer of support to the softening growth forecasts. The Index has been decelerating for the past five quarters but remains above its historical average.3 An optimist may look at the Index’s recent movement as another data point confirming slower, but continued, growth for the U.S. economy. A pessimist could view today’s significant economic uncertainty – regarding business spending and hiring, but also consumer spending, trade tensions and monetary policy, among other factors – as having begun to erode business sentiment, potentially leading to a hard landing or recession.

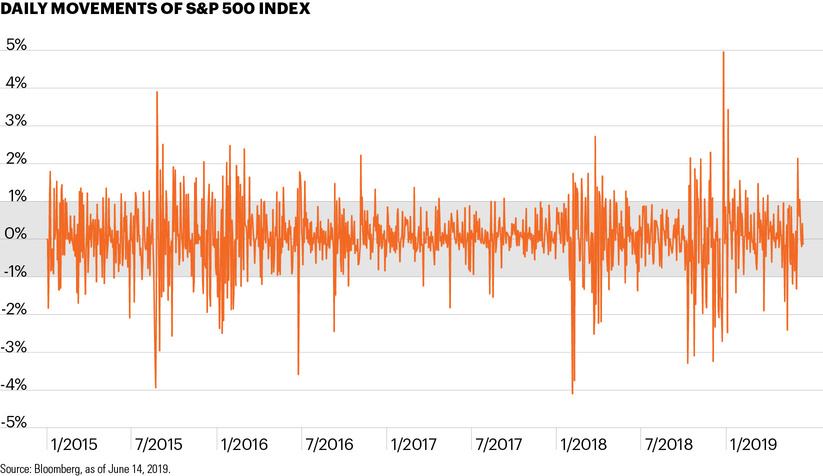

Early this year, markets recovered most of the ground they lost in Q4 2018. Looking back through the past 18 months, however, equity markets have seen multiple down-up-down moves, while price returns have been relatively flat. At the same time, daily volatility has spiked since Q4 2018, as the chart shows.

It will take time to decipher the ultimate arc of the slowdown. No matter the severity, though, economic slowdowns have typically proven challenging for investors and today’s environment appears to be following suit. For equity investors, elevated volatility will likely remain the overriding feature of markets for the foreseeable future. Investors need to find ways to manage their portfolios through the economic slowdown and increasingly uncertain environment across traditional equity and fixed income markets.