Why FSCO now?

With over $2 billion1 in assets, FS Credit Opportunities Corp. (NYSE: FSCO) is one of the largest credit-focused closed-end funds by asset size in the public market.

Our flexible strategy allows us to invest in loans, bonds and structured credit, across public and private markets, and in both fixed and floating rate coupons with a focus on senior secured debt.

Our flexibility and closed-end fund structure has helped deliver:

| An attractive dividend |

| Strong total returns |

| Low average duration |

FSCO scorecard

9%

Target annualized distribution at listing2

1.25

Years average duration3

+60%

Floating rate assets4

+80%

Senior secured debt5

Since 1/2018, outperformed

High yield bonds by

237

bps per year6

Loans by

127

bps per year6

Since 1/2018, outperformed

| ||||||

9%Target dividend2 | 1.18 yearsAverage duration3 | +60%Floating rate assets4 | 81%Senior secured debt5 |

|

Goodbye, 60/40

It’s no secret the traditional 60/40 portfolio simply isn’t doing what it used to for investors. Rather than hanging on in a bad relationship, hoping we can capture what’s been lost, we believe now is the time to walk away—for good—from the 60/40.

In a market where flexibility and investment discipline are critical to driving return and generating income, we need a strategy like FS Credit Opportunities Corp. We truly feel we need to pursue the attractive dividend and access to credit opportunities in both public and private markets that FSCO offers.

We wish we could say we’re sorry, but we’re not.

The team behind FSCO

The FS Investments Special Situations and Liquid Credit team was founded by Andrew Beckman and Nick Heilbut in 2018. The full breadth of their investment expertise to source, analyze and structure a broad universe of investment opportunities, such as in syndicated and private credit, private equity and structured products, reflects the team’s extensive experience.

$3B+

Assets under management1

10

Investment professionals

16

Average years’ experience

5

Credit cycles the team has invested across

300+

Investments made since 2018

Andrew Beckman

Head of Liquid Credit & Special Situations

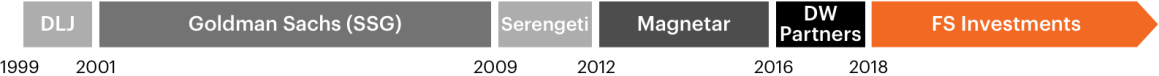

Mr. Beckman spent much of his career at Goldman Sachs as Co-Head of the Special Situations Multi-Strategy Investing Group. More recently, he was the Head of Corporate Credit and Special Situations at DW Partners and Head of the Event-Credit business at Magnetar Capital.

View Andrew’s profile

Nicholas Heilbut

Portfolio Manager, Director of Research

Mr. Heilbut worked with Mr. Beckman at Goldman Sachs in the Special Situations Multi-Strategy Investing Group. More recently, he was a Managing Director at DW Partners focusing on stressed and distressed debt and Head of Research for Magnetar’s Event-Credit business.

View Nick’s profile