We are FS Investments

A global alternative asset manager dedicated to delivering superior performance and innovative investment solutions

30 years of leadership in private markets

FS Investments is an alternative asset manager dedicated to delivering attractive returns across private equity, private credit and real estate. Following its 2023 acquisition of Portfolio Advisors, FS Investments now manages over $82 billion for both institutional and wealth management clients around the world, drawing on 30 years of experience and more than 500 employees operating across nine global offices.

The firm’s investment professionals manage a wide range of differentiated strategies across private markets and collectively manage relationships with 300+ sponsors. FS Investments’ active partnership model creates a virtuous cycle of superior market insights and deal flow, which inform the underwriting process and help to generate strong returns.

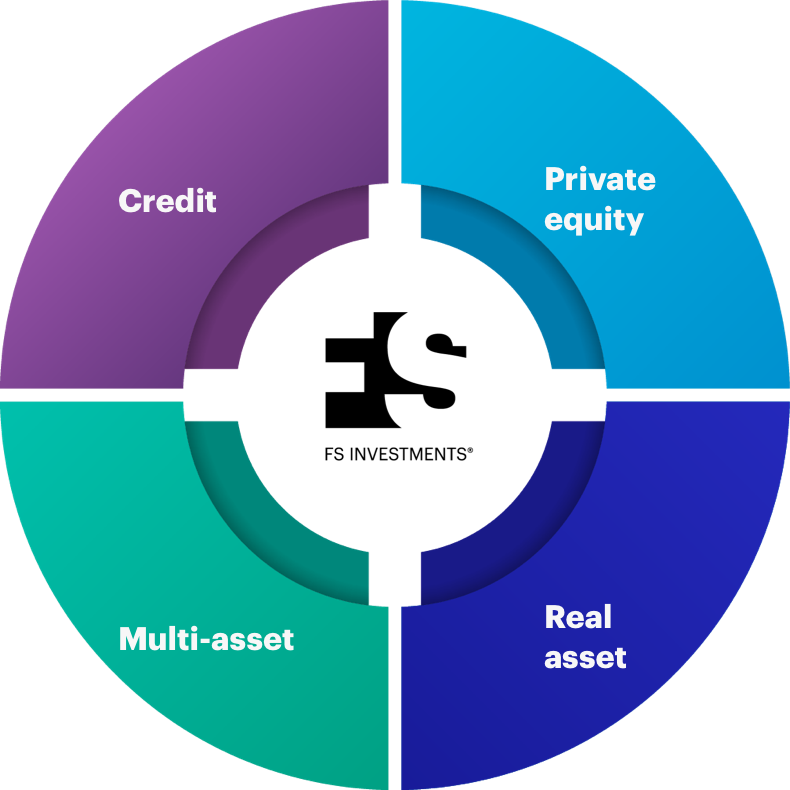

A complete alternative solutions provider

Credit

Private credit

Credit secondaries

Multi-sector credit

Special situations

Private equity

Direct co-investment

Secondaries (LP- and GP-led)

Primaries

Real asset

Real estate credit

Real estate secondaries

Multi-asset

Global allocation

Multi-strategy

Key facts All data as of 3/31/2024

$82B+

Assets under

management

9

Global offices

(Headquartered in

Philadelphia)

30

Years of experience investing on behalf of institutional clients

500+

Professionals

worldwide

22

Private and public

market offerings

Our story – transforming the investment landscape

Michael Forman launches Franklin Square with co-founder David Adelman and a small group of colleagues.

FS Global Credit Opportunities Fund launches as the first unlisted closed-end fund.

Franklin Square reaches $10 billion in assets under management.

FSIC, the industry’s first non-traded business development company, lists on the NYSE.

Doors open at the new company headquarters, located in Philadelphia’s historic Navy Yard.

Franklin Square becomes FS Investments.

FS Energy Total Return Fund launches in partnership with Magnetar Asset Management.

FS Multi-Strategy Alternatives Fund launches in partnership with Wilshire Associates Incorporated.

FS Credit Real Estate Income Trust launches in partnership with Rialto Capital Management.

FS Credit Income Fund launches in partnership with GoldenTree Asset Management.

FS Long/Short Equity Fund launches.

FSIC merges with Corporate Capital Trust and is renamed FS KKR Capital Corp. (FSK).

Fund mergers form FS KKR Capital Corp. II, the second-largest business development company.

FS Investments acquires Chiron Investment Management, LLC.

FS KKR Capital Corp. (FSK) and FS KKR Capital Corp. II (FSKR) merge, creating a $15 billion BDC.

FS Investments partners with NYDIG to offer access to simple, efficient, and cost-effective bitcoin products.

FS Chiron Real Assets Fund launches.

Philadelphia Financial Scholars becomes independent 501(c)3.

FS Credit Opportunities Corp. (FSCO) begins trading on the New York Stock Exchange.

FS Investments and Portfolio Advisors combine, creating a $75 billion+ alternative investment firm.

FS MVP Private Markets Fund launches.

Our resources

FS Investments is committed to empowering our partners with the latest in alternatives education, investment research and value add programming.

Know your alternatives™

Know your alternatives is our full suite of educational resources for alternatives investing. Get up to speed on the essentials with strategic resources designed to fit advisor workflows.

Investment research

Our nationally recognized investment research experts offer insight and analysis on the latest in macroeconomic movements and key market trends.