More of our insights

As equities rallied in 2021, core fixed income fell

Core fixed income is on pace for its first negative year since 2013. Our chart looks at the Agg’s annual returns, why this year may be different.

5 for ’22: Corporate credit

After the roller-coaster that was 2020, 2021 felt eerily calm in credit markets. Are we in for more of the same next year? Here are 5 big ideas we’ll be watching in corporate credit in 2022.

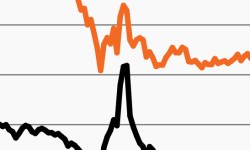

Equities, and expected rate volatility, bounce together

Expected equity volatility quickly settled though it continued to climb in the rates market. Our chart revisits the divergence.

Credit market commentary: November 2021

Credit markets declined in November. Loans returned -0.16% while HY bonds were down -1.02%, their second monthly decline and worst performance since March 2020.

As short-term rates spike, long-term rates fall further

Benchmark rates have fallen as inflation jumps, highlighting an unexpected relationship. Our chart looks at the changing yield curve this year.

As inflation rises, real yields fall further

October’s inflation report continues to rattle markets, as real rates have plummeted. Our chart looks at the wide gap between nominal and real rates.