More of our insights

Research Roundtable: Q2 2021 Market outlooks

Members of the Investment Research team gather to discuss their predictions for Q2 2021.

Credit market commentary: March 2021

Interest rate volatility continued to weigh on markets for much of the month.

Q2 2021: Right on track

It’s been one year since markets bottomed. With the end of the pandemic hopefully in sight, fundamentals improving and economic forecasts robust, we think the backdrop for credit remains supportive.

Rising inflation expectations ripple across the markets

Rates and inflation expectations moved higher this week. Our chart looks at why the Fed isn’t concerned, but markets could remain choppy, nonetheless.

Quantifying COVID: Credit markets one year later

Credit markets have largely recovered from the pandemic. How could continued optimism impact investors?

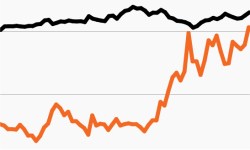

Leveraged credit climbs amid rising rate environments

As Treasury yields jump, flexibility is key. This week’s chart looks at historical returns for credit when yields have risen quickly.