More of our insights

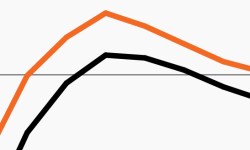

Wide performance dispersion may favor active managers

Dispersion between best- and worst-performing S&P sectors is at a 20-year high. This week’s chart tracks it over time and outlines why it matters.

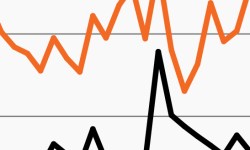

Stock and bond volatility jump together

Volatility has escalated this year across stock and bond markets. This week’s chart looks at daily changes in the S&P 500 and the Agg.

A battle emerges between sentiment and earnings

Eroding sentiment has driven markets down, yet fundamentals remain firm. This week’s chart looks at the divergence, why it could drive volatility.

Treasury and equity volatility reach recent peaks

Markets have been choppy and there could be more to come. This week’s chart looks at recent rises in expected equity and Treasury volatility.

Q1 2022 3D Report: Low Vibration

The global economic order is likely at a crossroads, and investors will need help navigating what is coming.

Investors bracing for a potential policy mistake?

Investors expecting rapid rate hikes, followed by a quick reversal? Our chart looks at market expectations for a possible policy mistake.