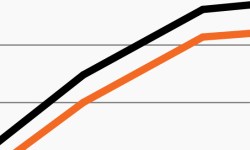

Growth tops value (again) as rates fall

There’s been no standout growth-value winner in 2021. This week’s chart looks at market leadership and emphasizes why flexibility has been important.

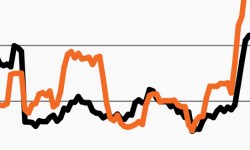

Yields decline despite rising inflationary pressures

As inflation rises, longer-term yields have declined. This week’s chart looks at the yield curve as the hunt for yield gets harder.

Active management paramount even amid healthy credit markets

Credit fundamentals look good, yet finding returns can be tough, especially for passive investors.

As long rates fall, core fixed income stuck in the middle

Long rates have declined despite rising inflation readings. This week’s chart looks at the declining yield curve and why core FI is in a tough spot.

Rate expectations remain near zero for the long term

Prices have risen, but rates remain anchored. This week’s chart looks at Fed funds rate expectations, noting that the income problem is here to stay.

Despite rate pause, the Barclays Agg remains underwater

The Barclays Agg remains in negative territory YTD despite a kinder rate environment. We compare core fixed income returns in 2020 and 2021.