Read the articles

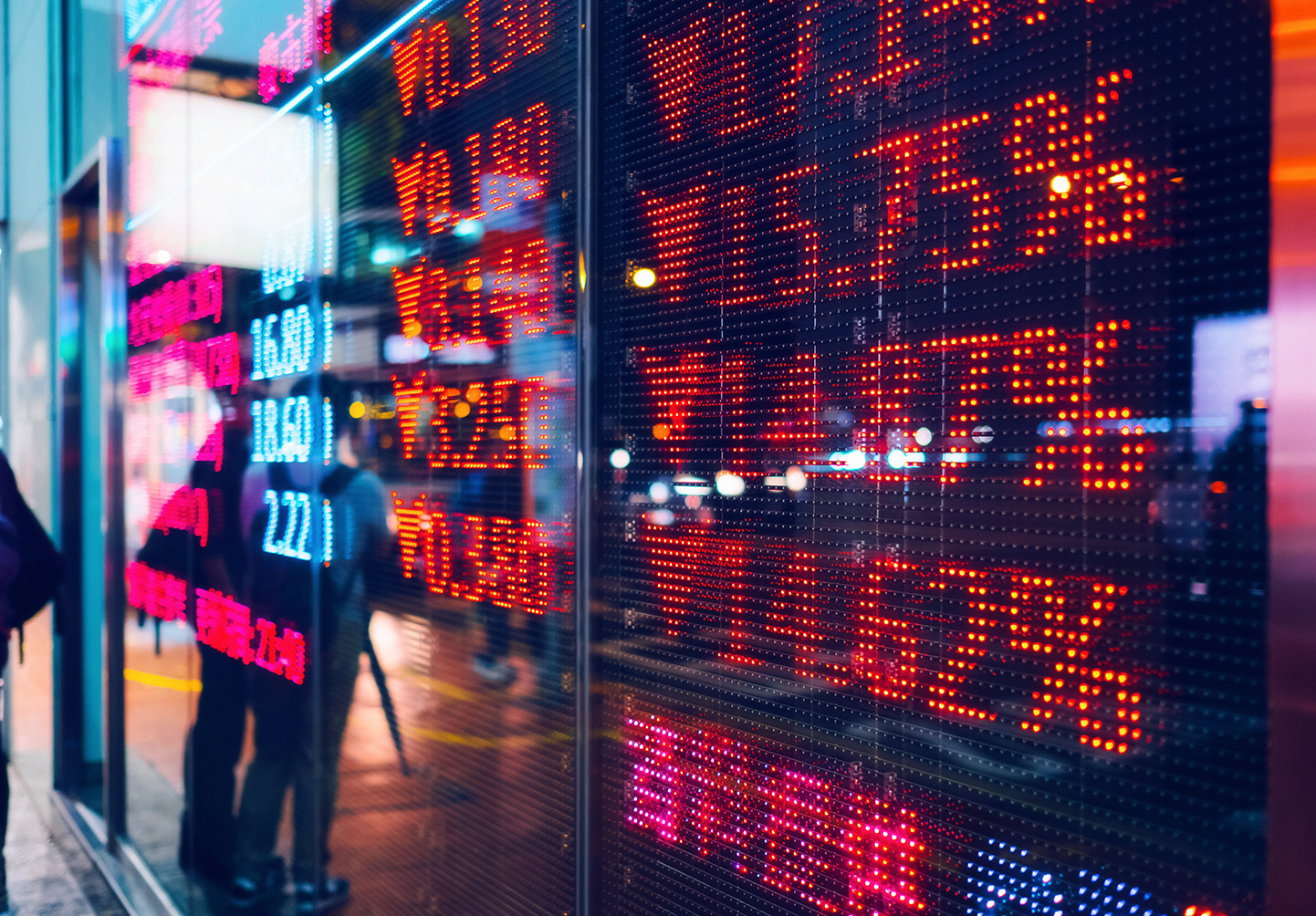

LIBOR: A transition unlike any other

Lining up the last days of LIBOR

LIBOR reform: From theoretical to tactical

It’s complicated: Leveraged loans and the LIBOR transition

SOFR and the path forward

The missing piece: SOFR’s place in the post-LIBOR puzzle

Leaving LIBOR

About the authors

Lara Rhame, FS Investments

Lara is Chief U.S. Economist and Managing Director on the Investment Research team at FS Investments, where she analyzes developments in the global and U.S. economy and financial markets. Her fresh take on macroeconomic issues helps to inform and develop the firm’s long-term views on the economy, investment trends and issues facing investors. Lara is committed to the Philadelphia community and serves on the boards of the Economy League of Greater Philadelphia, Hyperion Bank and Starr Garden Park.

Tal Reback, KKR

Tal is a Principal at KKR where she is responsible for leading the firm’s global LIBOR transition effort across private equity, credit, capital markets and real estate. Day to day, Tal focuses on the firm’s credit portfolios and leads KKR Credit’s business content and branding initiatives. She serves as a member of the Federal Reserve Board and New York Fed’s Alternative Reference Rates Committee (“ARRC”), the public-private sector working group to help ensure the market’s successful transition to alternative rates, and a member of the LSTA. Tal previously worked as an analyst specializing in distressed debt, restructuring and event-driven investments. She holds a BA in Economics and Art History from Brandeis University.

Andrew Korz, FS Investments

Andrew is a Director on the Investment Research team at FS Investments, where he leads research efforts on the energy sector and the U.S. commercial real estate market. He also assists in the development of the firm’s long-term views on the economy and the impacts on the investing environment. Andrew holds a BBA in Finance and Economics from Villanova University and has prior experience with structuring and pricing interest rate derivatives.

About the series

Solving the puzzle of LIBOR reform is a collaboration between FS Investments and KKR, two leading firms with experience in financial products benchmarked to LIBOR. Planning for the LIBOR transition has quickly gone from theoretical to tactical—and the stakes are high, as a smooth transition is vital for financial stability as the 2021 deadline looms.