The past year has felt like a daunting road trip for commercial real estate investors—long, winding and requiring lots of patience. The destination has the potential to be exciting, promising improved return expectations, but there remains a long way to go, and the threat of potholes and wrong turns is ever-present. The ongoing correction in commercial real estate (CRE) markets will likely continue into the second half of the year, although resilient economic fundamentals and more robust capital markets should help the market avoid something worse.

Key takeaways

- CRE transaction activity remains sluggish as prices normalize to higher interest rates.

- Outside the office sector, fundamentals have been remarkably stable.

- Power has shifted from borrowers to lenders, who are in position to drive attractive terms.

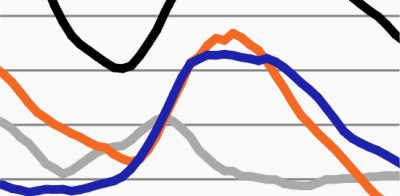

The U.S. CRE market has undergone a significant correction over the past year. Property values, which soared 30% in the 24 months to July 2022, have fallen -12% since then, with the bulk of the declines occurring during the first half of this year.1 This correction can largely be attributed to the sharp rise in interest rates across the fixed income space; this has not only forced property yields higher to compete with more attractive yields in other asset classes, but also sent financing costs for leveraged investors soaring. While cap rates have risen anywhere between 60 bps and 100 bps depending on the sector, the correction in values likely has further to go to catch up with the rise in interest rates since early 2022.1

Read the complete Q3 Commercial real estate outlook to learn more.