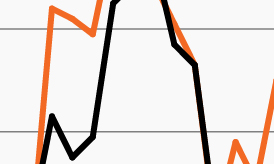

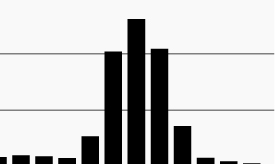

CRE vacancy rates by property type

Source: MSCI Real Capital Analytics, as of April 30, 2023.

- Amid regional bank stress, tightening lending standards and rising mortgage rates, the commercial real estate (CRE) market remains among investors’ primary concerns. Indeed, it is in the process of a correction as CRE property prices and deal volume have declined precipitously as buyers and sellers seek a new equilibrium.

- Despite the macro stress and headline risk, the CRE market is very large and diverse with multiple performance drivers. Notably, the recent correction appears to be primarily driven by rising rates as opposed to weakening fundamentals. In fact, the underlying cash flow fundamentals for most property types outside of office continue to be quite stable.

- As the chart shows, national vacancy rates in three of the four major property types remain well contained, either in line with the pre-COVID trend or well below it in the case of industrial.1

- Office is the clear outlier as its stress has been well documented. Office is a key real estate sector, but also has become a much smaller component of the market over time (just 14% of sale volumes over the past 12 months through April).1

- While fundamentals remain solid across much of the CRE market, the price correction could remain in place as the market comes to terms with higher financing costs. Against this backdrop, returns will likely be driven by income, rather than price appreciation as it was for much of the past decade. In turn, the risk/reward outlook looks to favor lenders over borrowers.