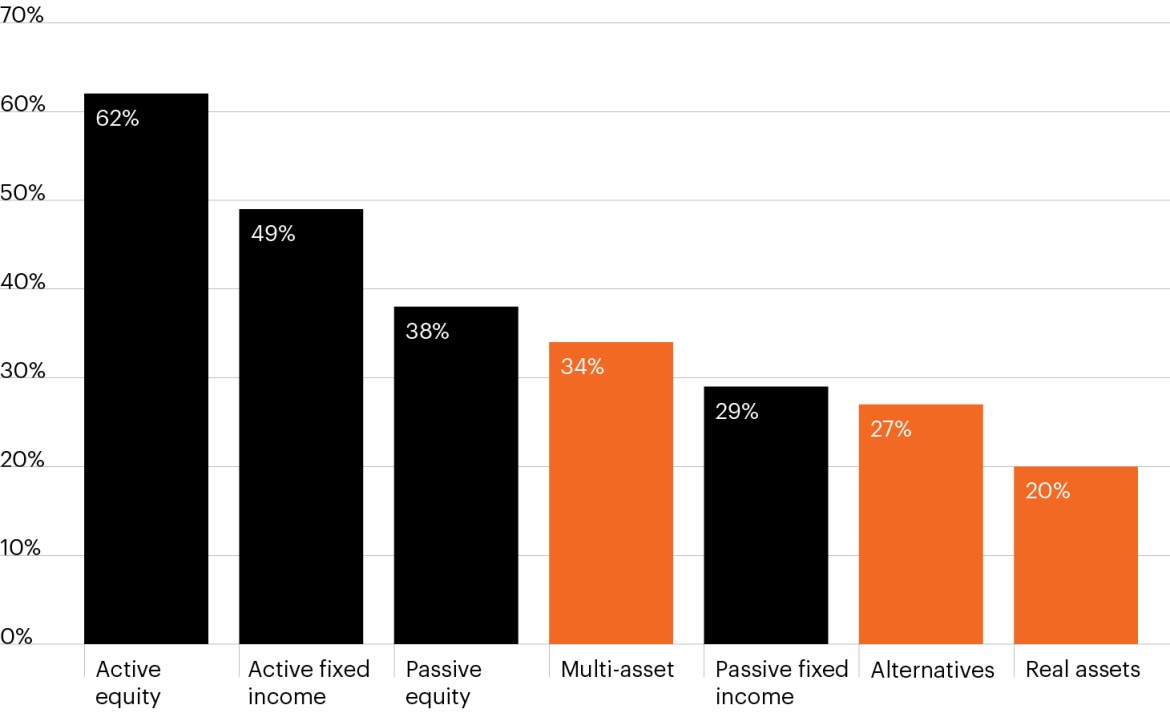

Advisor plans to redeploy cash over the next 12 months

Source: Fuse Research, as of April 2024.

- Money market fund assets under management ballooned over the past year, peaking at more than $6.1 trillion as investors sought the relative safety of cash at elevated yields for much of the year.1 Amid persistently hotter-than-expected inflation readings, however, cash has become significantly less attractive as its real return shrinks.

- Against this backdrop, many advisors have begun to redeploy cash within clients’ portfolios given the significant opportunity costs of maintaining too large a cash balance. According to Fuse Research, 72% of advisors surveyed plan to reallocate their clients’ portfolios out of cash back into the market over the next 12 months.2

- Active managers are poised to be one beneficiary, as advisors look to move back into active traditional equity (62%) and fixed income (49%) funds.2

- Alternatives, multi-asset and real asset investments, however, were also big winners according to the survey, garnering significant interest as the chart highlights.

- Advisors are increasingly allocating to these areas as they seek alternative sources of total return and diversification potential against a highly concentrated equity market that has reached historic levels of correlation with core fixed income.