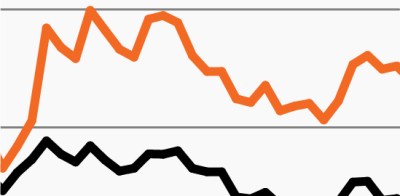

“Big 7” tech stocks vs. the broader S&P

Source: Bloomberg Finance, L.P. as of October 3, 2023. Top 7 contributors refers to a market-cap weighted index of Apple, Amazon, Microsoft, Nvidia, Alphabet, Meta and Tesla. Past performance is no guarantee of future results.

- U.S. stocks have encountered significant volatility recently as Treasury yields have risen unrelentingly over the past month. Yet, the S&P 500’s headline return of 13.1% through Q3 2023 remains strong even when measured over an annual period.

- Digging under the hood, though, the S&P’s return is notably less impressive. It has been extremely concentrated, almost exclusively driven by the largest growth-oriented technology stocks.

- As the chart shows, a market-weighted index of the largest seven technology stocks has returned 55% year to date, which is more than 5x the return of the broader S&P 500.1

- As the weighting of the top 10 stocks in the S&P 500 has risen close to its highest on record, approximately 30% of the Index, the S&P 500 equal weight index is down -2% year to date.1

- Despite the strong headline returns in 2023, the chart highlights the challenging investment environment that remains in place for the majority of stocks, including the need for flexibility and the importance of finding alternative sources of growth.