Strong economic growth is now fully baked into market expectations which, ironically, places markets in a newly vulnerable position. When expectations are so positive, the threshold for a downside surprise becomes incredibly low. In this note, I look at why publicly traded equities are left particularly exposed, and why suddenly downside data surprises are piling up.

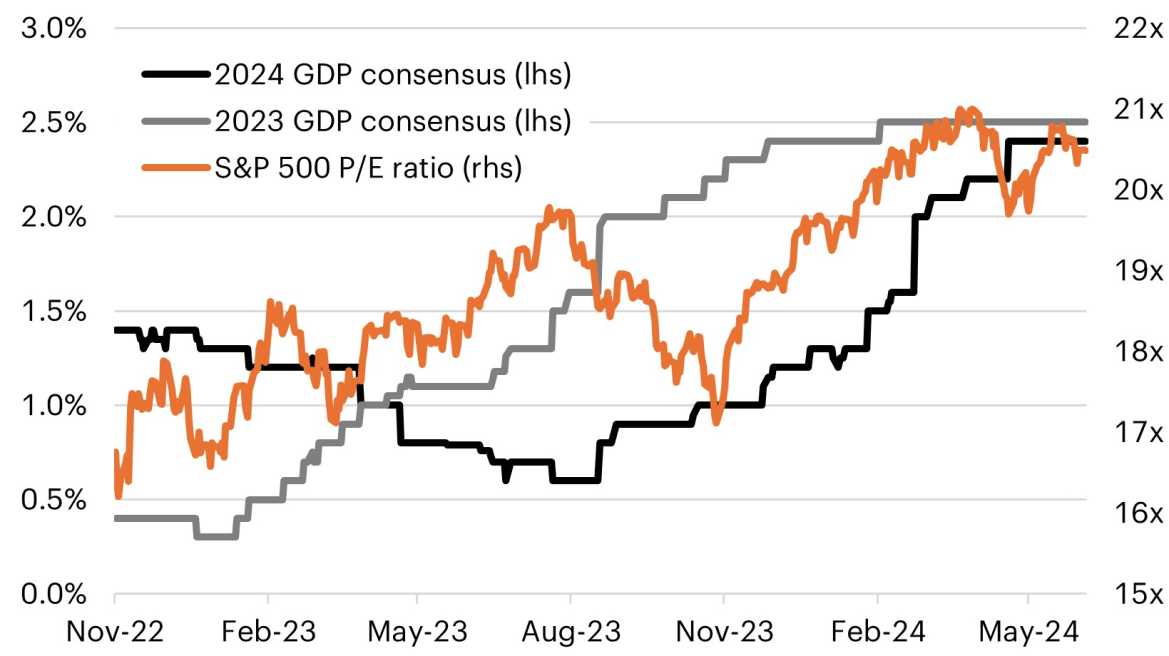

A giant swing from pessimism to optimism. 2023 went down as a big swing and a miss for forecasters, and the miss continued into the first half of 2024. It isn’t often that you get to read a note about how wrong economists were—written by an economist—so you know it must be important! The Fed’s most aggressive rate hike cycle in four decades caused economists to forecast a recession. At the start of 2023, the median forecast was GDP growth of just 0.3%, with over half of economists expecting a recession. The graph below shows the evolution of the consensus economic forecast. As it became clear that a contraction wasn’t going to happen in the first half of 2023, the economist herd just doubled down on the recession (growth slowdown) forecast and rolled it forward. In the middle last year, while forecasts for 2023 GDP were rising, the forecast for 2024 GDP was falling.

I am not blameless in this. I have time stamped a conversation with a colleague in late 2022 when I gave numerous reasons why the economy would be resilient in the face of challenges including excess savings, a secular upswing in business investment, tight labor market supply that would limit layoffs, a healthy banking system and strong corporate balance sheets. And yet, with a deeply inverted yield curve and unprecedented, aggressive rate hikes, my years of experience told me a shallow recession was the most likely outcome.

One by one, forecasts of a recession, a slowdown or even sluggish growth, have peeled away and the consensus today is for growth of 2.4% in 2024, which follows growth of 2.5% in 2023. This is a strong pace of growth! Over 18 months, markets have watched an epic swing from forecasts of recession to expectations of growth well above potential growth. Far from cooling, the economy has stayed red hot. This isn’t just reflected in GDP. Expectations that the labor market would slow have also been mistaken. Instead, the unemployment rate has remained below 4% for over two years – below the Fed’s estimate of the “natural” rate of unemployment of 4.1%. Inflation has also remained elevated, a byproduct of this rapid pace of growth.

Economic optimism helped power valuations

Source: Bloomberg Finance, L.P., as of June 3, 2024.

Markets have loved it—a strong economy means strong revenue generation and earnings growth. Nominal GDP was 6.3% in 2023 and if inflation stays at 3% (as I expect) nominal GDP growth will be 5.5% in 2024.

Full throttle, maximum optimism. I don’t usually say this, but in this case, it is good to be wrong. No one should root for a recession, which by definition includes painful job losses and economic hardship. In fact, I spend most of my time talking people out of concern of recession. I remind investors that our economy wants to grow—it naturally grows, as labor market growth and productivity growth provide a natural tailwind. Ironically, an elevated Fed funds rate is one reason to expect the economy to avoid a recession. Today, with the Fed funds rate at 5.25%, the Fed has room to cut rates significantly should the economy slow unexpectedly. This is a luxury policymakers have not had for 10 years when the Fed funds rate was at 0%.

And make no mistake, today we are at gang busters, full throttle optimism. Most estimates of potential (or trend) real GDP growth for the U.S. economy are 1.75% to 2%. Yet last year we grew 2.5% (2.9% looking at Q4/Q4). This year’s expectation of 2.4% GDP growth is very strong indeed, and ties directly to a similar optimism in equities where earnings are expected to grow 11% in the next four quarters versus 6% in the prior four quarters ending in Q1. Today, this is the foundation upon which valuations in the publicly traded space are balanced.

The upside down of expectations and outcomes. One of the first lessons anyone learns in markets is what matters is the outcome versus expectations. For example, we’ve all witnessed an earnings call where the expectation was for a big drop in revenue, so when a moderate drop in revenue is reported it sparks a rise in price—because it still counts as an upside surprise relative to expectations.

This is the punchline: Today, with strong economic expectations baked in, we are in the mirror situation for the economy compared to last year. Suddenly, after almost a year when the economic data consistently beat expectations, we have seen the data deliver a string of notable downside surprises.

Data surprises erode support for equities

Source: Bloomberg Finance, L.P., as of June 3, 2024

On Monday, the ISM slumped to 48.7 in May, deeper into contraction territory and reversing a cautious uptrend. Consumer spending seems to be moderating—albeit from an unsustainable pace of spending—and an early look at Q2 data showed real household spending fell -0.1%. The news isn’t all bad, by any stretch. Business investment has been close to expectations, and the services ISM was stronger than expected. The data do not reflect a weak economy, but the outcomes are now more downbeat than the extraordinary optimism markets are expecting.

We believe this environment leaves publicly traded equities considerably vulnerable going forward, particularly compared to large-cap private equity, which has already had to adjust to higher interest rates, in a way that publicly traded large caps have simply sailed past. In today’s higher interest rate environment, the equity risk premium is negative. In other words, only higher for longer earnings growth can overcome higher for longer interest rates. Even a moderation in growth toward 2% GDP—which would be more consistent with the “soft landing” narrative—would imply a slowdown in earnings growth. Not enough for the Fed to slash rates, but enough to shine an uncomfortable light on the fact that today the equity risk premium is still negative.

Optimism about the economy is well-founded. Household spending may finally ease up after years of arguably unsustainable spending. But as long as the labor market remains solid and income growth keeps up with inflation, there is little reason to expect consumer spending to contract. The outlook for business spending remains positive, as well, given deglobalization and infrastructure spending.

While the first half of the year has been dominated by fixed income volatility as Fed rate expectations corrected from expecting seven rate cuts to between one and two rate cuts—a much more likely outcome—market valuations could buckle under the weight of their own optimistic expectations the second half of the year as growth data will likely come into greater focus.