Markets bear the brunt of steepening

Interest rates continue to rip higher, and this week the 10-year Treasury yield hit close to 5%, a 16-year high. Several fundamental factors are colliding to push rates higher, including strong economic data, Fed determination to push against rate cuts, and increased supply of government debt. But under the surface, something more insidious is happening; a bear steepening has caught markets off guard and is wreaking havoc on traditional returns. We dig into the dynamics of a bear steepening, explain why it is so uncomfortable, and why it could have further to go.

Yield curve dynamics in the driver’s seat: Bond geeks love terminology. Yield curve inversion—when long-term rates are lower than short-term rates—has been the catchphrase since the Fed started raising rates, and with good reason. When the Fed embarks on a rate hike cycle the yield curve almost always inverts (one counter example was the early 1990s, when the Fed’s relatively mild rate hike cycle merely flattened the yield curve). Yield curve inversion is one of the strongest, and most reliable, leading indicators of recession. After all, when the Fed raises rates it’s trying to slow the economy down. Higher interest rates slow demand in interest-rate sensitive sectors. But an inverted yield curve also puts pressure on the banking system. When banks are forced to reckon with their cost of deposits rising faster than the rate at which they can lend, their net interest margins come under pressure and credit conditions tighten. Yield curve inversion has preceded each recession going back decades.

When yield curve inversion eventually corrects to its more “normal” shape—in other words, steepens—markets typically do well. Ironically, this is often when the economy is weakening and the Fed is cutting rates to rescue growth. Equity markets, ever attempting to peer around the next corner, anticipate a robust rebound aided by easing policy. This time around, however, things have been painfully, and uniquely, different.

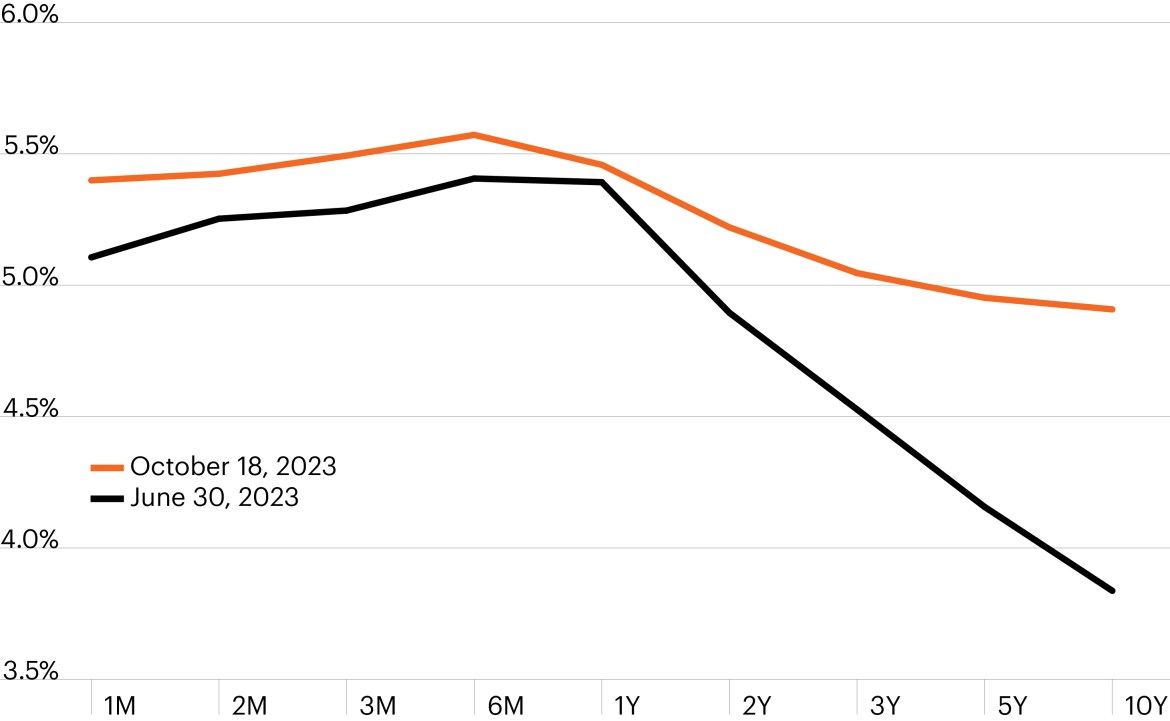

Bulls vs. bears: Let’s decode the lingo. A bull steepener occurs when bond prices are rising, and rising faster in the short-term part of the yield curve, sending yields down faster in the short-end. The classic bull steepener in the late stages of the monetary policy cycle occurs when the Fed cuts rates, bringing short-term rates down. However, what is happening now is a bear steepener. Bonds are selling off across the board, with a more acute sell-off in long-term bonds, sending long-term yields higher. This is the dynamic that has dominated the bond market in the third quarter. The 2-year Treasury yield rose 14 bps in Q3, while the 10-year jumped 73 bps. Adding the first two weeks of October brings the total yield change to 32 bps in the 2-year versus 114 bps in the 10-year. This radical bear steepening is totally unique at this stage of the monetary policy cycle.

Treasury yield curve: Bear steepening since the start of Q3

Source: Bloomberg Finance, L.P., as of October 18, 2023.

Strong data are a catalyst: When we say strong, we mean supercharged. September retail sales rose 0.7% m/m, versus a consensus of 0.3%, the third upside surprise in a row that makes the consumer seem unstoppable. Employment rose 336,000 in September, rounding out almost 800,000 new jobs in the third quarter as job growth looks to be reaccelerating. Finally, consumer prices rose 0.4% in September, but details looked to be moving in the wrong direction. The Fed has put the spotlight on core services excluding housing—now known as “supercore”—which jumped 0.6% m/m, the most since September of last year. Estimates of Q3 GDP range from 3.5%–5.0% (the Atlanta Fed’s GDPNow estimate is 5.4%), far above the underlying potential of the U.S. Fed Chair Powell spoke on Thursday and signaled no rate hike in November, but said “additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.” Read: Rate cuts need to come out of market expectations, and rates will be higher for longer.

Expect the unexpected: Fed rate hike cycles are notorious for triggering or exposing unexpected events in financial markets. In this monetary policy cycle, the bear steepening, in and of itself, is the unique and unexpected event. The chart below shows the drivers of the last eight monetary policy cycles when the yield curve steepened from inversion. Five of the last seven, circled in green, were bull steepeners with lower short-term yields. Two times, circled in yellow, the yield curve steepened from a combination of lower short-term yields and higher long-term yields. This is the first time that yield curve inversion has begun to correct because of a bear steepening.

10-year – 2-year yield curve: The shape of past steepenings?

Source: Bloomberg Finance, L.P., NBER, FS Investments, as of October 13, 2023. Shaded regions are NBER-designated U.S. recessions.

Note: Shaded ovals denote the primary source of steepening throughout the steepening cycle.

Markets get mauled by bear tightenings: There is no sugarcoating the pain a bear steepening causes markets. The difference between the annualized average returns during inverted bear and bull steepeners is night and day. It is not the steepening in and of itself that brings in a new investing cycle, it’s the move in the short end from the Fed capitulating. Today, the economy has arguably strengthened throughout the year. The bear steepening environment speaks to how hard it may be for the Fed to retrain markets away from anticipating rate cuts, even if the Fed would like to wind down rate hikes.

Avg. annualized returns of stocks and bonds

During periods when yield curve steepened from inversion

| Stocks | Bonds | |

| Bull steepening | 6.3% | 23.8% |

| Bear steepening | -8.2% | -8.5% |

| Current bear steepening | -7.8% | -11.5% |

Source: Bloomberg Finance, L.P., FS Investments, as of October 13, 2023.

Note: Performance is measured based on rolling 4-week periods since 1977. Bull steepening periods represent any 4-week period in which the yield curve is inverted, both the 2-year and 10-year yield fall, and the 2-year yield falls more. Bear steepening periods represent any 4-week period in which the yield curve is inverted, both the 2-year and 10-year yield rise, and the 10-year yield rises more.

This could have further to go: After the extraordinary increase in yields of Q3, where do we go from here? The Fed’s rate hike cycle, after all, is probably quite close to the end, if not there already. But the current Fed funds futures curve, which anchors the broader arc of the yield curve, still lags Fed projections. Notably, the Fed’s latest economic projection shows a Fed funds rate of 5.00–5.25% at the end of 2024, while markets expect 60 bps of rate cuts. This correction alone would imply room for long-term yields to move higher still.

Far from a clean getaway: Finally, recession risk has receded from the market in the second half of the year, an understandable reaction to the strong economic data. Yet we are cautious to proclaim “this time is different.” We note that yield curve inversion, regardless of the shape of the yield curve’s resteepening, still correctly forecasts recession. A recession is not a foregone conclusion. While we still forecast a recession in 2024, reasons the recession could be mild (labor hoarding, infrastructure spending, and a more resilient banking system) also mean we could escape an outright contraction.

Managing through the coming quarter will likely involve more wrestling with this bear steepener. Traditional markets are poorly positioned for this, precisely because it is so unique and unexpected at this phase of the tightening cycle. Investors have been trained over decades that the reward for their enduring a Fed rate hike cycle is the asset price punch bowl that is delivered at the end as the Fed cuts rates. With that scenario off the table for the foreseeable future, markets are left to trudge through the forest with very few historical comparisons to use as a flashlight. Ultimately, this bear steepener not only poses issues for traditional equity and bond markets, but also stands to heighten risks to the U.S. economy.