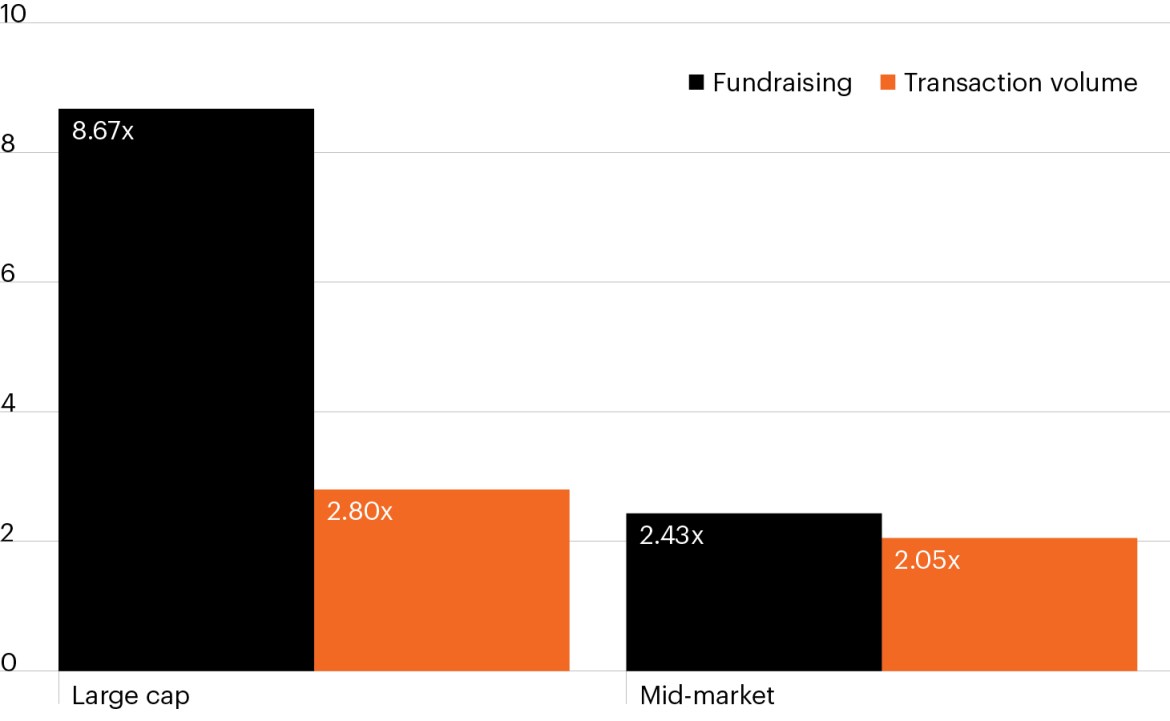

Growth in fundraising and transaction volume: 2011 to 2023

Source: Pitchbook, FS Investments, as of December 31, 2023.

- Private equity fundraising has seen enormous growth in recent years, driven by its historical outperformance versus public equities along with growing retail interest. Private equity assets under management grew 172% for the six-year period ended December 2023 while dry powder—capital that has been raised but not yet deployed—grew 59%.1

- Much of the fundraising has centered on large- and mega-cap PE sponsors. Yet the tremendous growth also has posed a unique problem for them: the capital raise has massively outpaced transaction volume.

- From 2011 to 2023, the growth in large cap fundraising outpaced actual transaction volume by more than 580%.2 Meanwhile, fundraising among middle market PE sponsors has been much more closely aligned with their target opportunity set.

- Significantly more money chasing large- and mega-cap deals has led to notably higher multiples (17.3x) there than in the mid-market space (14.4x).2

- Large- and mega-cap PE sponsors garner most of the headlines and continue to lead fundraising efforts in 2024. Yet the U.S. middle market presents a deeper opportunity set comprised of more than 200,000 businesses and may offer a more attractive long-term growth opportunity than that of its large cap peers.