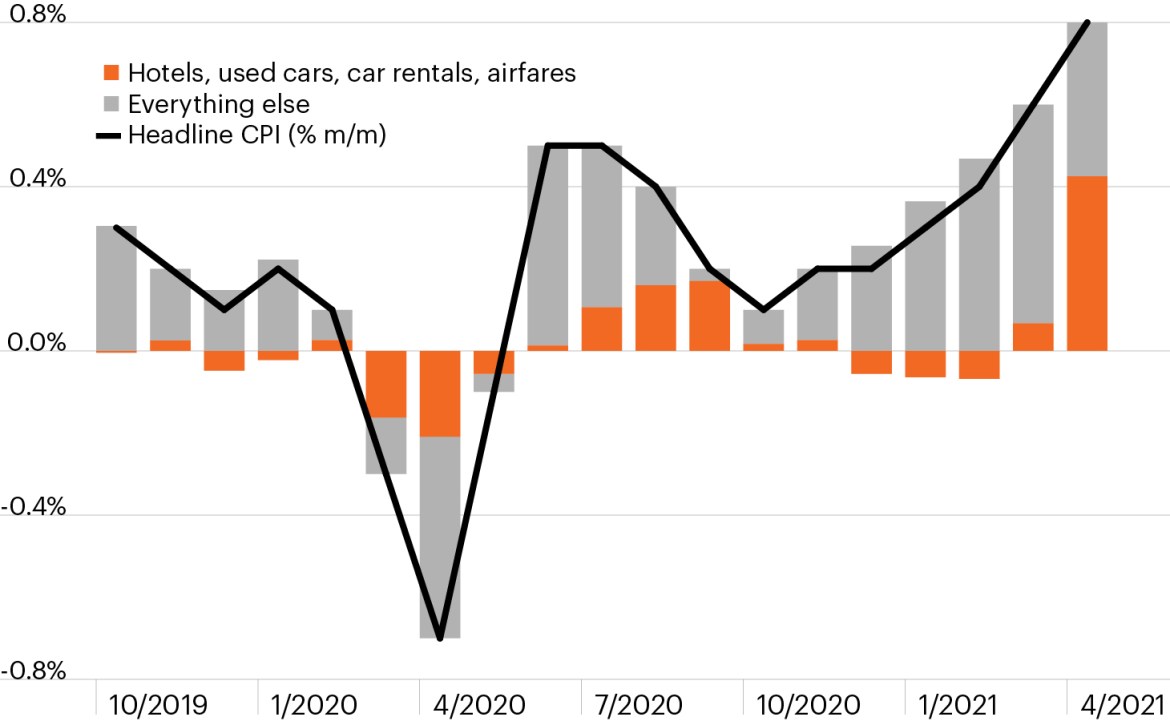

Monthly change in CPI by component

Source: Bloomberg Finance, L.P., as of April 30, 2021. Based on data from the U.S. Bureau of Labor Statistics.

- For much of this year, investor concerns surrounding inflation were purely speculative. However, April CPI data showed consumer prices rising 0.8% from a month earlier and 4.2% from a year earlier — the first month to show inflation indeed running significantly higher than expected.1

- Aside from some volatility in the equity markets, though, the market reaction was largely muted. The 10-year U.S. Treasury yield moved higher but remains in the same range it’s occupied since mid-March. Market-based expectations for Fed rate hikes, meanwhile, are largely unchanged from a month ago.

- Digging into the CPI data may reveal a potential reason for the muted market reaction: A notable part of the CPI increase may prove to be transitory. Used car and airfare prices both jumped 10% from a month earlier.1 Together with other COVID-sensitive areas (hotels and car rentals), these components account for only about 5% of the CPI but accounted for half of the monthly increase.1

- The rise in used car prices could prove to be the short-lived result of supply-side bottlenecks in the new car market, while it seems likely that airfare hikes are the result of a post-pandemic reopening. Other areas of the CPI report, which might drive prices higher on a more sustained basis, remained modest. Shelter and owners’ equivalent rent, for example, rose just 0.2% from a month earlier.

- With just one month’s data in hand, investors are left to speculate as to whether higher inflation is a passing trend or a sobering new reality. Whatever answer proves true, it seems fair for investors to prepare for further market choppiness, as the coming months are ripe for continued speculation.