Money market madness

Last year, playing defense with your portfolio made sense. Now you may be missing out.

Money market madness

Last year, playing defense with your portfolio made sense. Now you may be missing out.

Last year, money markets were a safe play

Over $1 trillion flowed into money market funds in 2023 amid the most aggressive Fed rate hike cycle in history. With the Fed likely done raising rates, investors may see the forces that attracted them to cash last year turning into reasons to reallocate in 2024.

$1T

Inflows to money market funds in 20231

$5.89T

Total assets in money market funds as of 12/31/20232

It’s game time

Now is the time to make a game plan for how to best put your cash to work. Alternative investment strategies may provide your portfolio with the all-star power it needs to take on 2024.

Commercial real estate debt

Consider senior, floating rate loans backed by commercial real estate properties seeking to generate an attractive level of income, preserve capital and diversify a traditional portfolio.

Explore our CRE offeringsMulti-sector credit

Consider an allocation across public and private credit, based on greatest relative value opportunities to generate income and long-term capital appreciation.

Explore our credit offeringsMulti-strategy liquid alternatives

Consider a multi-strategy liquid alternative seeking to generate positive, low-correlated returns over a market cycle.

Explore our liquid alternative offeringsPrivate U.S. middle market equity

Consider investing in private U.S. middle market companies for differentiated sources of long-term growth.

Explore our private equity offeringsMoving to cash in 2023

Why moving to cash made sense in 2023:

Rate hikes: Fed Funds rose to 5.50% following the most aggressive Fed rate hike cycle in history.

High inflation: Expectations for “higher for longer” rates amid falling, yet persistently high inflation.

Economic pessimism: Concerns over the health of the U.S. economy and the potential for a recession.

Fixed income: Fixed income real rates finally turned positive.

It may be time to check your lineup. Money market assets keep growing despite yields declining.

Source: Bloomberg Finance, L.P., as of February 1, 2024.

Tackling cash in 2024

Why 2024 may be a good time to put cash back in the game:

Rate cuts: The Fed’s pivot at their December 2023 meeting explicitly called for rate cuts in 2024.

Falling inflation: Forecasts for slow but continued decline in inflation.

Economic optimism: Resilient U.S. corporate health and expectations for a soft landing.

Opportunity cost: Historically high yields and real returns outside of Treasuries—and high opportunity cost of staying in cash.

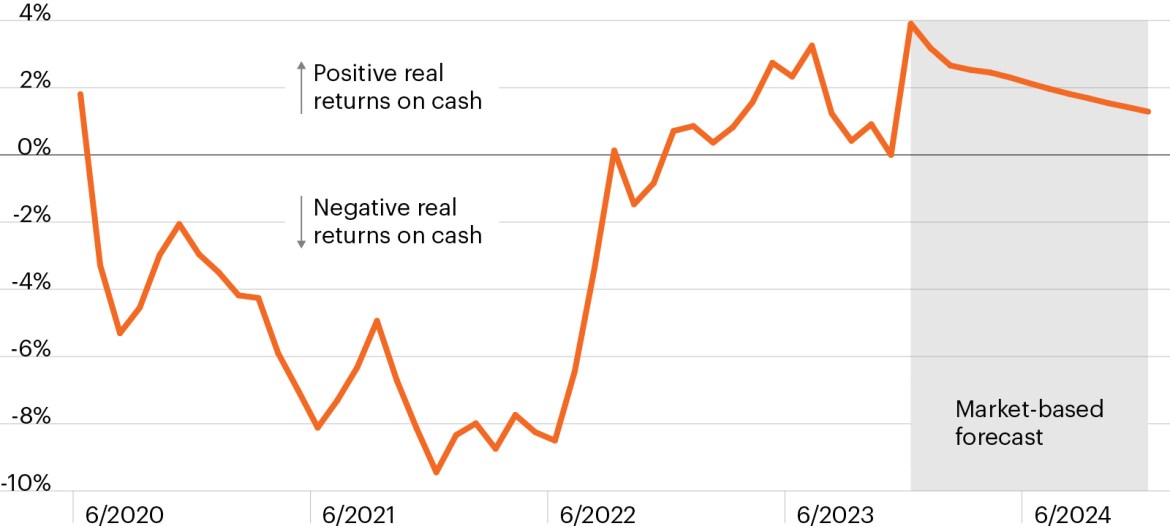

Real returns on cash may have peaked

Source: Bloomberg Finance, L.P., as of December 31, 2023. Data shows the 3-month T-bill return minus the rate of headline CPI inflation. The market-based forecast for 2024 utilizes current Fed funds futures pricing and consensus headline CPA forecasts, per Bloomberg.

Real return is what is earned on an investment after accounting for taxes and inflation.

Related resources

Dare to Dream is now a wonderful reality!

Read the latest strategy note from our Chief Market Strategist Troy Gayeski.

Read the strategy note

Lara Rhame’s 5 for 5

Chief U.S. Economist Lara Rhame discusses five key challenges facing investors in 2024 and five opportunities that may provide income, growth and diversification.

Read the insights article

Family offices plan material increase to private markets

This chart of the week looks at family office CIOs’ plans to increase allocation to alts in 2024, specifically private credit and private equity.

View the chart of the weekView important disclosures

1. Source: Bloomberg Finance, L.P., as of February 1, 2024. Money Market Fund AUM is represented by ICI All Money Market Funds Total Nets Assets.

2. Source: St. Louis Federal Reserve as of December 29, 2023.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. FS Investments is not adopting, making a recommendation for or endorsing any investment strategy or particular security. All views, opinions and positions expressed herein are that of the author and do not necessarily reflect the views, opinions or positions of FS Investments. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. FS Investments does not provide legal or tax advice and the information herein should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact any investment result. FS Investments cannot guarantee that the information herein is accurate, complete, or timely. FS Investments makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

Any projections, forecasts and estimates contained herein are based upon certain assumptions that the author considers reasonable. Projections are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the projections will not materialize or will vary significantly from actual results. The inclusion of projections herein should not be regarded as a representation or guarantee regarding the reliability, accuracy or completeness of the information contained herein, and neither FS Investments nor the author are under any obligation to update or keep current such information.

All investing is subject to risk, including the possible loss of the money you invest.