Happy Holidays! As equity markets continue to make lower highs and lower lows, also known as a bear market, a galactic mean reversion, or a sloppy, choppy mess, investors should continue to seek to:

- Protect capital: Don’t be a hero. Don’t be greedy. Focus on allocations to strategies that offer return streams in the mid to high single digits with lower volatility.

- Don’t chase bear market rallies in equities or fixed income. Instead, use them as an opportunity to lighten up on beta and duration.

- Prioritize economically resilient cash flows and total returns.

- Roll up the capital structure in real estate: Lock in gains, improve income and total return and minimize downside risk.

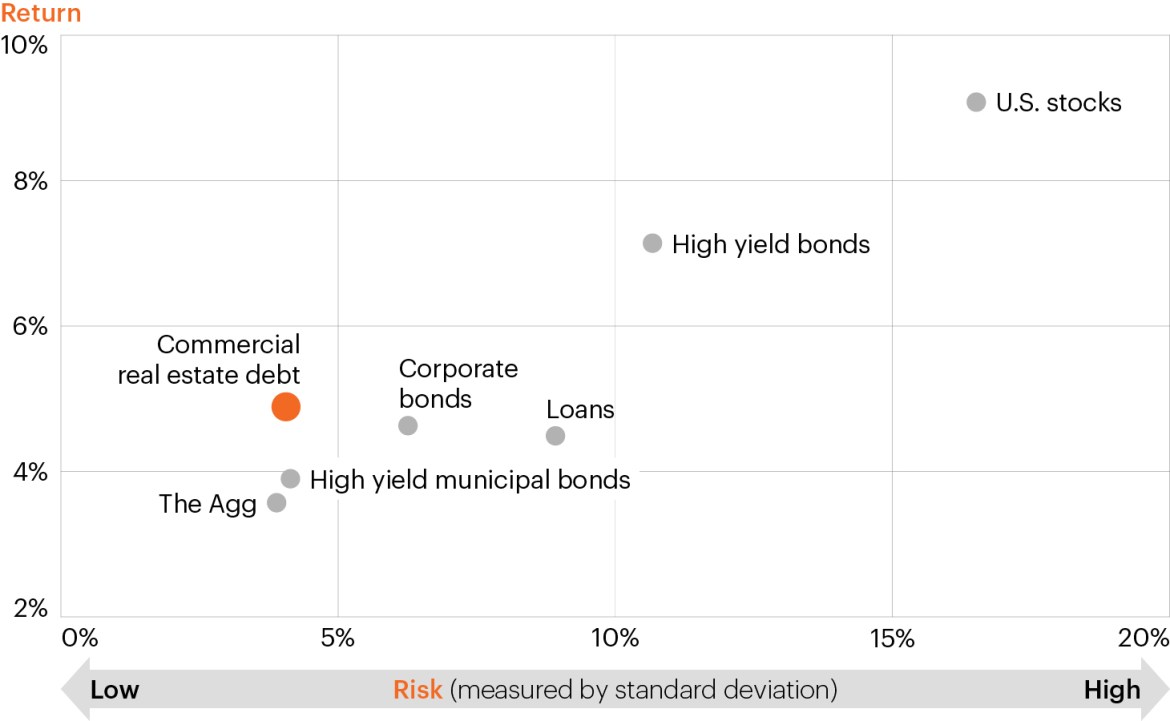

- Focus on strategies in the northwest quadrant of the efficient frontier: For the bulk of your asset allocation, chase low risk of loss, low volatility strategies that have a fighting chance to generate mid to low high single digit returns like an oasis in the desert (such as private senior secured asset backed commercial real estate loans or low beta/low duration multi-strategy solutions). If you can tolerate more risk, make sure you are receiving attractive income (Listed Business Development Companies (BDCs) and closed-end funds that trade at a discount to NAV, for instance).

- Don’t Fight the Fed, High Five the Fed: Focus on high quality floating rate assets (as opposed to the lower quality syndicated bank debt/leveraged loan market which is in for a rough ride).

- Fight inertia and embrace democratized alternatives.

Now, let’s take a look at the evolving landscape of real estate and how it is improving a potential opportunity for an alternative strategy located in the northwest quadrant of the efficient frontier: Private senior secured commercial real estate lending.

Annualized risk and total return (6/30/2002–6/30/2022)1

Past performance is not indicative of future results. The beginning time periods referenced are based on the availability of index data. This data is for illustrative purposes only and is not indicative of any investment. An investment cannot be made directly in an inbox.

- We highlight commercial real estate (CRE) debt now because out of the handful of strategies that have performed admirably this year, only a small subset of them has potentially better opportunities in 2023. There are many strategies (growth equities, duration, beta, international equities) that have gotten obliterated in 2022, and arguably have a chance to at least lose less money in 2023 compared to 2022. And, sure, there are a few strategies (equity REITs, fully invested perpetual BDCs) that have performed well in 2022, but have a potentially much darker outlook in 2023. How many strategies performed in line or exceeded expectations in 2022 that could have better outlooks in 2023 compared to 2022? Two examples are private senior secured commercial real estate lending and multi-strategy funds.

- One of the key attributes of this cycle has not been only the magnitude of market (interest rates, equities, currencies, commodities, real estate, etc.,) moves up, down, sideways, backwards and forward, but also the speed of those moves. Commercial and residential real estate are adhering to this phenomenon as well (Galactic Mean Reversion Part I evolves to Galactic Mean Reversion Part II).

- A fundamentally driven (strong demand and constrained supply) real estate bull market got supercharged by fiscal and Fed stimulus, and voila, hockey stick parabolic upward moves in price occurred from the acute stages of the pandemic to Q2/early Q3 of this year. After extreme price gains, we are now officially in a real estate correction. It’s now time to roll up the capital structure and focus on private senior secured commercial real estate private loans in order to increase income and reduce risk:

- Recession risk looms: Since recession risk has increased substantially (some would say close to 100% between Q2 of 2023 and Q1 of 2024) and real estate prices have begun to decline, there are far fewer strategies that may continue to generate positive returns over the next 12 to 24 months.

- Post-Global Financial Crisis (GFC) headwinds become tailwinds: Lower interest rates and tighter lending spreads have turned into tailwinds with the potential to increase income and total return going forward, making for a quite a cheerful holiday season indeed for senior CRE lenders with capital to lend.

- Where the opportunities might be: Many alternative real estate lending strategies have focused on acquisition and development financing. However, now that banks are becoming increasingly constrained by recession risk, CMBS issuance has slowed substantially, and many listed alternative lending strategies (mortgage REITs) are tapped out on capital—a new opportunity has emerged to lend to borrowers on high quality/trophy properties as existing loan maturities come due. From our perspective, a majority of the higher quality opportunities the next several years may be providing financing to borrowers that need to roll their loans.

- Increasing borrowing costs: As borrowing interest rates have increased, there is basically a massive wealth transfer taking place in real estate from owner/operator to the lender. Floating rate loans originated at wider spreads/yields lead to increased income as the Fed continues to hike and interest rates increase.

- Resilient income: No strategy can make money in every environment, but CRE lending has many attributes in its corner today that other asset classes simply don’t. Underwriters have remained disciplined with modest loan to values (LTV), which has served to protect investor’s capital in market downturns. Credit losses during the GFC peaked at just slightly above 1% in 2011. The asset class has also historically provided low beta to not only equities (0.08) but also to real estate prices (0.07) over the last 20 years.2

- Risk aversion: Institutional borrowers will do everything in their power to avoid handing over the keys of a performing property or even a temporarily money-losing property in times of stress, which is one of the main reasons senior CRE loan defaults peaked at less than half of high yield bonds in the global financial crisis.

- Big drops: It takes a significant drop in property value to potentially cause a loan loss/impairment. Hypothetically, even a 37% drop in property values (greater than the global financial crisis!) would only cause a 10% loss, well below the 70% loss severities typical in high yield bonds.

- Rebounds: There is no law that says properties must be sold at a loss. Formerly performing properties with high occupancy and attractive long-term demand vs. supply characteristics are experiencing a temporary cash flow problem usually rebound quickly once the real estate market turns.

- Resilient and dynamic: The combination of potentially lower default risk and low loss severities make the asset class resilient to economic and market downturns. Also, loans typically carry a three-year average life, so there is a potential opportunity to reallocate by sector and geography much faster than most private investment strategies.

- Alpha opportunity: There is an alpha proposition that is all about trading off loan to value, spread, sector, geography and borrower within a $5.3 trillion asset class.

- Floating rate: Since assets are primarily floating rate, investors may continue to benefit from a Fed committed to crush inflation.

- Reduction in tax liability: There is also a reduction in tax liability because the income is generated from real estate.3

- The downside: CRE assets won’t participate in real estate appreciation, but that is yesterday’s trade.

- In terms of forward-looking opportunities, here are some of the better ongoing and improving opportunities:

- Geographies with strong population and income growth

- Multi-family: Even though property owners may take a price hit, the fundamentals for lenders still look strong given relatively tight supply, high occupancy levels and a continued lack of sufficient construction and supply of single-family homes.

- Hospitality and lodging: Travel and leisure activity has dramatically rebounded since the dark days of the pandemic and should be much more resilient to an economic downturn than in the past since middle class to wealthy consumers are now prioritizing services over goods and vacations over a fifth flat screen TV. The opportunity for lending against trophy properties in coveted locations has rarely been better.

- Brick and mortar retail: After a long decade plus purgatory where excess supply had to be purged, brick and mortar retail in the right locations has made a powerful recovery and has a bright outlook ahead. The opportunity to lend at low LTVs and wide spreads should continue to improve.

- Industrial and warehouse: LTVs and spreads became a little too frothy by the summer of last year, driven by unrealistic expectations for post-pandemic ecommerce demand and revenue growth. Now that gravity has reasserted itself (not just on go-go growth managers), LTVs have come down and spreads have widened meaningfully. Thus, this sector is back in favor from a lending perspective far faster than one could have dreamed of as recently as six months ago. It’s go-time again for industrial lending!

- The one major sector that continues to be challenged is major metro office towers, which looks like a replay of the slow-motion train wreck in brick and mortar retail over the last 10+ years up until very recently.

- Who owns the risk? This will primarily be an equity owner/operator risk of loss problem and losses will leak out over time. Just like in brick and mortar retail, there will more than likely be some degree of loan losses across banks and perhaps even listed mortgage REITs with exposure to high rise offices in bad locations (here’s looking at you, midtown Manhattan).

- Repurposing? In the right locations, properties can in theory be repurposed. However, it is expensive and challenging/impossible to repurpose major office towers given the layout of the buildings/floorplan. Without state and local aid, it will be a heavy lift for private capital to fund these transitions.

- Private senior secured commercial real estate lending used to be an asset class only accessed by institutional investors, but due to the democratization of alternatives, accredited investors can now participate alongside institutions.

- In the current hyper challenging market environment for 60/40, there are far more ways one can use private senior secured CRE lending within an individual or institutional investor’s asset allocation than the green-light-go years of 2020 and 2021:

- Income/duration sensitive fixed income replacement/complement: This golden oldie never goes out of style, particularly since the 10-year Treasury yield is back down to 3.68%!

- Equity replacement/complement: As the bear market continues, why lose money and tolerate all of the volatility when you can make mid to high single digits with potentially less volatility and risk of loss? Even when this bear market is over, equity gains are likely to be muted than that of the post-Global Financial Crisis period (think October 2002–October 2007 bull market versus March 2009 to December 2021 bull market), so why take more risk to generate similar (or worse) returns?

- Attract destination for any targeted/mandated real estate capital (as opposed to mezzanine funds) for the next several years, as property prices decline (roll up the capital structure).

- Low volatility total return opportunity to park capital earmarked for private equity or venture capital drawdown structures.

- Prime opportunity for overfunded pension plans that are reducing their risk profile in advance of immunizing their portfolios with Treasuries.

- Steady income for endowments or foundations that have a targeted per annum spending mandate.

In general, cash flow will be king for the foreseeable future and this could be the income generating, low risk asset in the current Galactic Mean Reversion or sloppy, choppy mess environment.

Investing in alternatives is different than investing in traditional investments such as stocks and bonds. Alternatives tend to be illiquid and highly specialized. In the context of alternative investments, higher returns may be accompanied by increased risk and, like any investment, the possibility of an investment loss. Investments made in alternatives may be less liquid and harder to value than investments made in large, publicly traded corporations. When building a portfolio that includes alternative investments, financial professionals and their investors should first consider an individual’s financial objectives. Investment constraints such as risk tolerance, liquidity needs and investment time horizon should be determined.