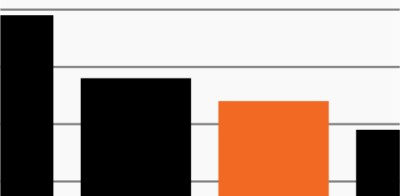

S&P 500 Index and ICE BofAML U.S. High Yield Master II Index

Source: Bloomberg Finance, L.P., as of July 30, 2020.

- U.S. markets’ rapid ascent since mid-March has amplified the divide between Wall Street and Main Street, as the market seemed to march past a virtual collapse within large parts of the U.S. economy. The recovery – nearly as quick as the decline across major stock and bond indexes – has reinforced for some investors the notion of a market that is forever forward-looking and perhaps overly optimistic.

- U.S. stocks and high yield bonds are now up approximately 45% and 25%, respectively, from their March lows and both asset classes are now roughly flat YTD.1 For investors who may have been taken by surprise by the market’s near-freefall in February, the recovery provides a rare opportunity to take a “mulligan” – that is, to rethink their portfolios in preparation for 2H 2020 and beyond.

- In fact, markets today bear little resemblance to those of three months ago, when the current rally began. The S&P 500 spent more than two months in a meteoric, largely tech-fueled rise but, as the chart highlights, equities have been relatively rangebound for the past six weeks, with notable challenges still to come. The same is true for high yield bonds.

- Wall Street executives recently have begun to echo Fed officials, who have been sounding alarms about the challenging economic picture since the start of the current health crisis.

- Against this backdrop, investors should not pass up the opportunity to reevaluate their investment priorities and goals. In today’s environment, actively managed investments that offer better insulation against future volatility while also bolstering income may be more important than ever